Financial uncertainty is an unavoidable reality that businesses face, especially in dynamic regions like Dubai & Abu Dhabi in UAE. The ever-evolving economic landscape—influenced by global markets, fluctuating oil prices, and geopolitical events—makes it critical for businesses to build robust financial strategies. Despite its importance, many businesses fail to adequately prepare for financial uncertainty. This blog explores why this is the case and provides actionable strategies to thrive during uncertain times.

The Reality of Financial Uncertainty in the UAE

The UAE’s economic framework is a unique mix of opportunities and challenges. In 2024 alone, the UAE’s GDP growth was projected at 3.5%, but factors such as global interest rate hikes and reduced oil output have introduced volatility. Businesses often face liquidity challenges, unpredictable consumer behavior, and rising operational costs.

Why Most Businesses Fail to Prepare for Financial Uncertainty

- Over-Reliance on Predictable Revenue Streams Many businesses operate under the assumption that past performance guarantees future stability. For instance, enterprises heavily reliant on tourism in Dubai witnessed significant disruptions during the COVID-19 pandemic.

- Lack of Diversified Financial Strategies Focusing solely on one revenue stream or market segment can lead to vulnerabilities. Diversification is often overlooked in favor of short-term profits.

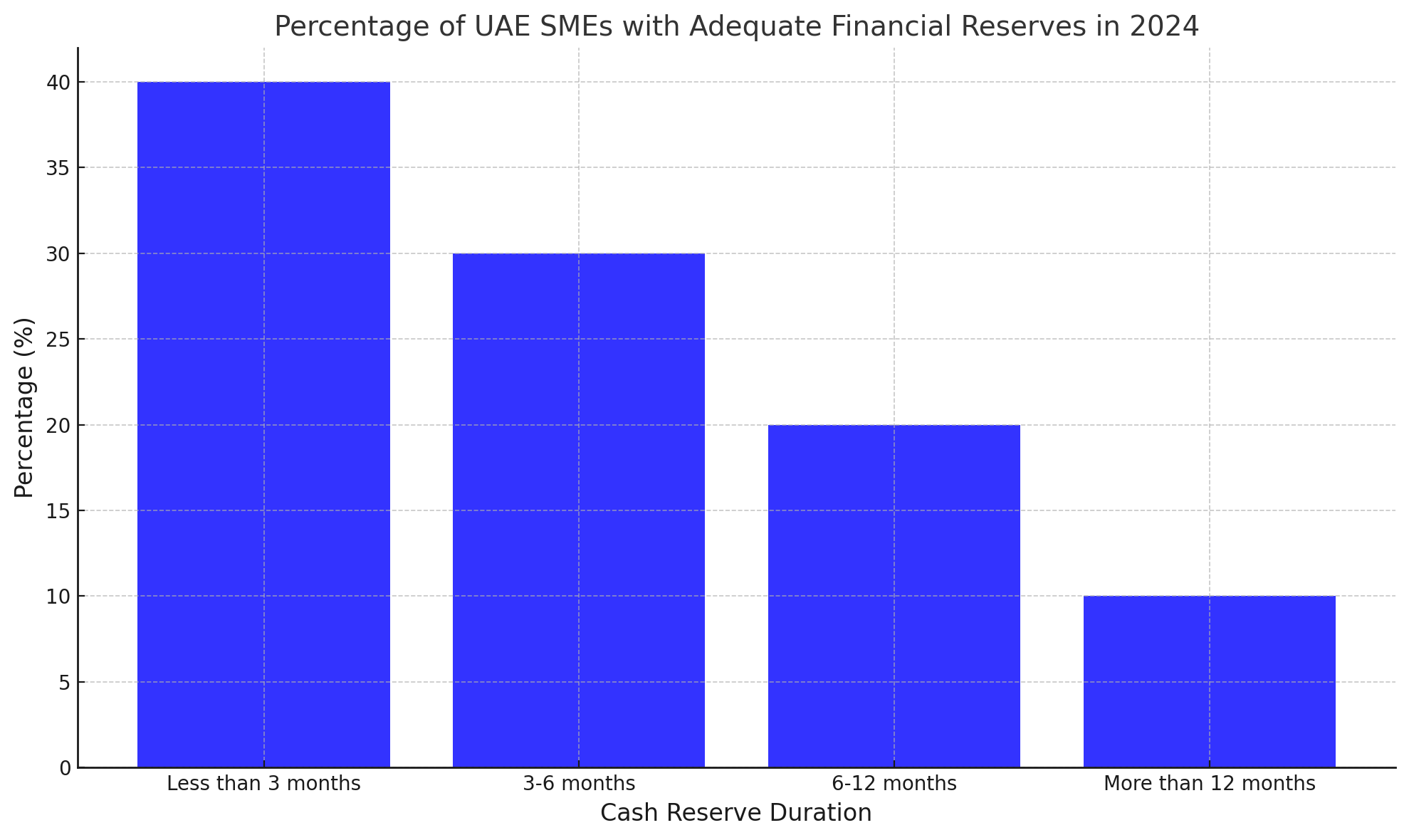

- Inadequate Cash Reserves According to a 2024 survey by the Dubai Chamber of Commerce, 40% of SMEs in the UAE have less than three months of cash reserves. This lack of liquidity is a major risk factor during economic downturns.

- Limited Use of Financial Technology Businesses that fail to leverage fintech tools for forecasting and analysis are often blindsided by financial uncertainties.

- Neglecting Contingency Planning In a 2023 KPMG study, 65% of UAE businesses admitted to not having a robust contingency plan for economic disruptions, leaving them vulnerable to market shocks.

5 Ways to Succeed During Financial Uncertainty

1. Build a Resilient Financial Plan A resilient financial plan includes clear forecasting, stress-testing against different scenarios, and building adequate cash reserves. Use tools like Xero or QuickBooks to manage financial data effectively.

2. Leverage Financial Technology Fintech solutions like AI-based forecasting tools can help businesses predict cash flow fluctuations and plan accordingly. According to PwC’s 2025 report, UAE businesses adopting fintech saw a 20% improvement in financial performance during uncertainties.

3. Diversify Revenue Streams Businesses can reduce risk by exploring new markets or launching complementary products. For example, during the pandemic, many Dubai-based companies shifted focus to e-commerce, achieving sustained growth.

4. Invest in Employee Training and Retention A well-trained workforce can adapt quickly to changes. Offering financial literacy programs ensures employees understand the importance of managing costs and improving efficiency during tough times.

5. Partner with Financial Advisory Services Organizations like Insights UAE specialize in offering tailored financial advisory services to businesses. By analyzing market trends and identifying risks, they help companies navigate economic uncertainty effectively.

The Role of Consumer Behavior in Financial Uncertainty

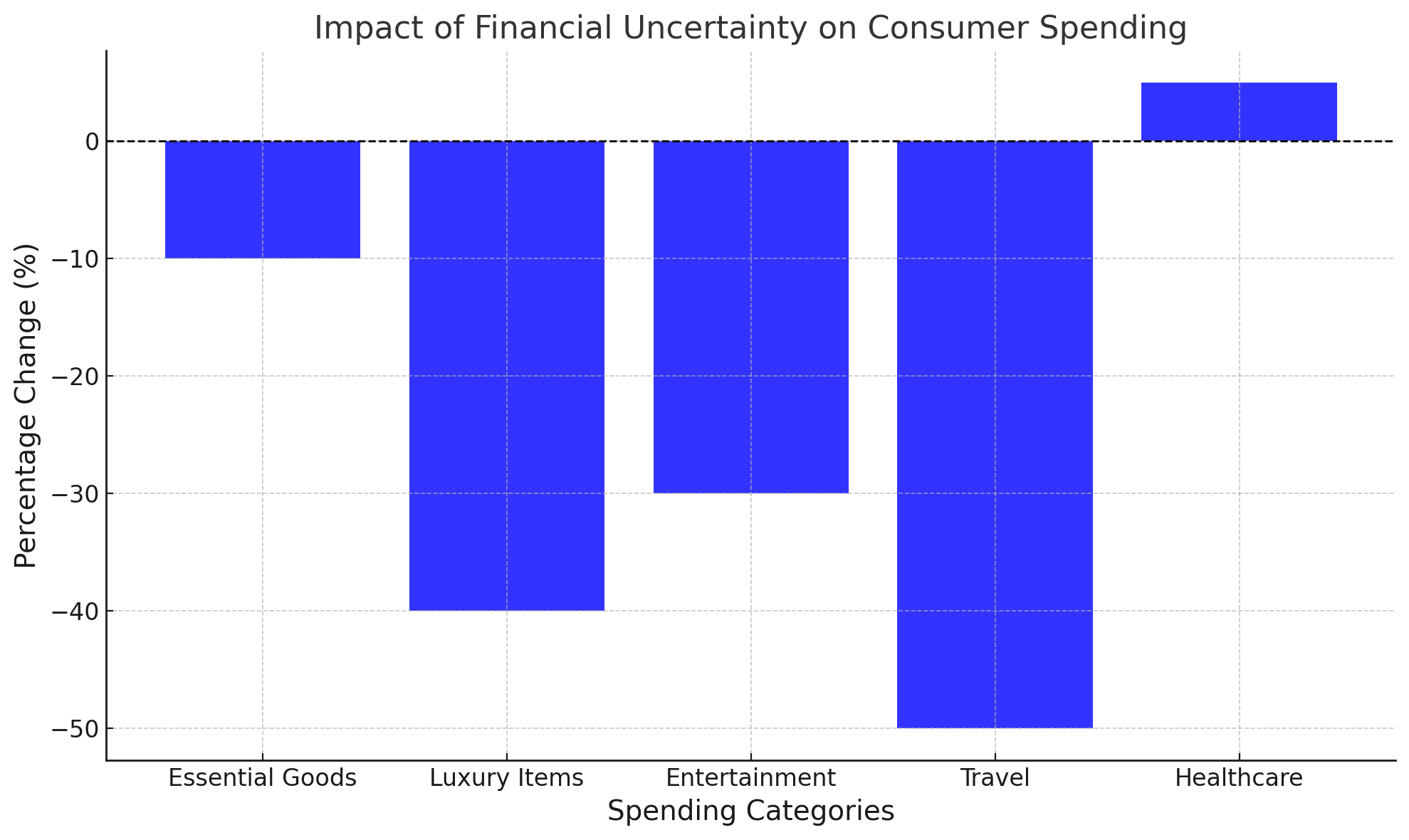

Consumer behavior in the UAE has undergone significant shifts over the past decade, influenced by rapid technological adoption and global economic trends. According to a 2024 Nielsen report, 68% of UAE consumers reduced discretionary spending in response to rising inflation, directly impacting sectors like retail and hospitality. Businesses that fail to adapt to these shifts risk losing market share.

By monitoring consumer trends and preferences, companies can realign their offerings to meet current demands. For instance, leveraging e-commerce and digital marketing can bridge the gap caused by declining foot traffic in traditional retail spaces.

Economic Diversification: A UAE Perspective

The UAE government 2019s commitment to economic diversification, as outlined in the Vision 2030 plan, presents both challenges and opportunities. Non-oil sectors contributed 70% to the GDP in 2024, reflecting progress. However, businesses in oil-reliant sectors faced a 15% revenue decline due to reduced output and fluctuating oil prices.

Adapting to this shift requires businesses to explore growth in technology, tourism, and sustainable energy. Companies that align with government initiatives, such as the Dubai Clean Energy Strategy 2050, are more likely to benefit from incentives and long-term growth prospects.

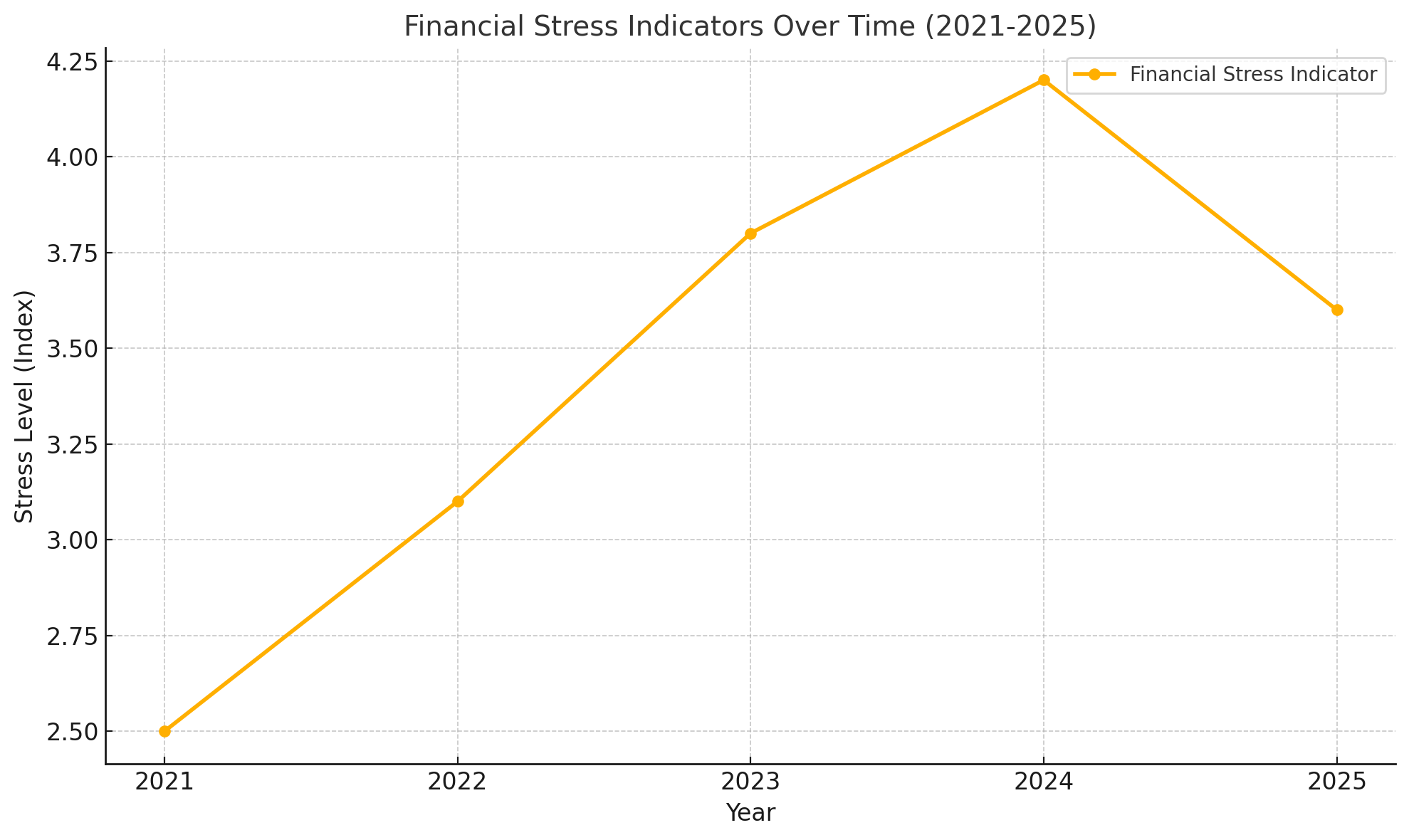

Financial Stress Indicators and Their Business Implications

Financial stress indicators like rising interest rates, currency volatility, and inflation rates are critical for assessing market stability. In 2025, the UAE Central Bank increased interest rates by 1.5% to curb inflation, directly affecting borrowing costs for businesses. According to a UAE Ministry of Economy report, 45% of SMEs reported higher operational costs due to these rate hikes.

To mitigate such impacts, businesses must adopt cost-control measures and refinance loans where feasible. Using predictive analytics can also help forecast these financial stressors and plan accordingly.

The Growing Importance of Digital Transformation in Mitigating Risks

Digital transformation is no longer optional for businesses in the UAE. A 2024 Deloitte survey found that companies leveraging digital tools reported a 25% increase in operational efficiency during economic downturns. Cloud-based solutions, AI-driven analytics, and blockchain are leading the charge in enhancing business resilience.

For example, a logistics company in Dubai improved supply chain efficiency by 30% using AI tools to predict delivery bottlenecks. This demonstrates the tangible benefits of adopting digital innovations to navigate financial uncertainty.

How Insights UAE Can Help

Insights UAE is a trusted partner for businesses in the region. They offer comprehensive solutions such as:

- Custom Financial Planning: Tailored strategies to mitigate financial risks.

- Risk Management: Team to identify vulnerabilities in your financial model.

- Market Analysis: Real-time data insights to stay ahead of industry trends.

For example, Insights UAE assisted a Dubai-based retail chain in reducing operational costs by 15% during a downturn through a combination of expense management and revenue diversification strategies.

FAQs

- What are the key indicators of financial uncertainty? Key indicators include fluctuating interest rates, declining consumer spending, and volatile currency exchange rates.

- How can small businesses in Dubai prepare for financial uncertainty? Small businesses should focus on cash flow management, diversify revenue streams, and use financial advisory services like Insights UAE to stay resilient.

- Is financial technology essential for managing uncertainty? Absolutely. Fintech tools provide real-time insights, enabling better decision-making during volatile periods.

- What role does market analysis play in mitigating financial risks? Market analysis helps businesses understand industry trends and adjust strategies accordingly to stay competitive.

- How does Insights UAE stand out from other financial advisory services? Insights UAE offers a localized approach tailored to the UAE market, combining global expertise with regional insights.

Financial uncertainty may be inevitable, but its impact on your business doesn’t have to be. By adopting resilient strategies, leveraging technology, and partnering with experts like Insights UAE, you can transform challenges into opportunities. The key lies in preparation, diversification, and staying informed.

With financial uncertainty on the horizon, the time to act is now. Equip your business with the right tools and knowledge to succeed in the UAE’s dynamic market.