For small businesses in the UAE, particularly in Dubai, managing payroll for small businesses can feel like a Herculean task. With the dual challenges of adhering to stringent regulatory frameworks and ensuring operational efficiency, payroll often consumes more time than expected. The trend in 2024–2025 shows that small businesses are increasingly looking for optimized solutions to reduce time and financial costs associated with payroll processing.

Why Is Payroll Consuming Too Much Time for Small Businesses?

The answer lies in three key areas that make payroll management a time-intensive and complex activity:

- Regulatory Complexity in the UAE

In the UAE, labor laws are stringent, and non-compliance can result in heavy fines or even business closures. Key factors adding complexity include:

- Wage Protection System (WPS):

- The UAE mandates the use of WPS for salary payments to ensure transparency and timely payments. Failure to comply with WPS regulations can result in fines ranging from AED 1,000 to AED 5,000 per violation (Dubai Labour Ministry, 2024).

- Keeping track of WPS filings, deadlines, and changes consumes a significant amount of time for businesses relying on manual payroll processes.

- Dynamic Labor Laws:

- The UAE labor market, driven by government policies like Emiratization, is evolving rapidly. Small businesses need to stay updated on employee benefit requirements, such as annual leave adjustments and overtime pay, making payroll even more cumbersome.

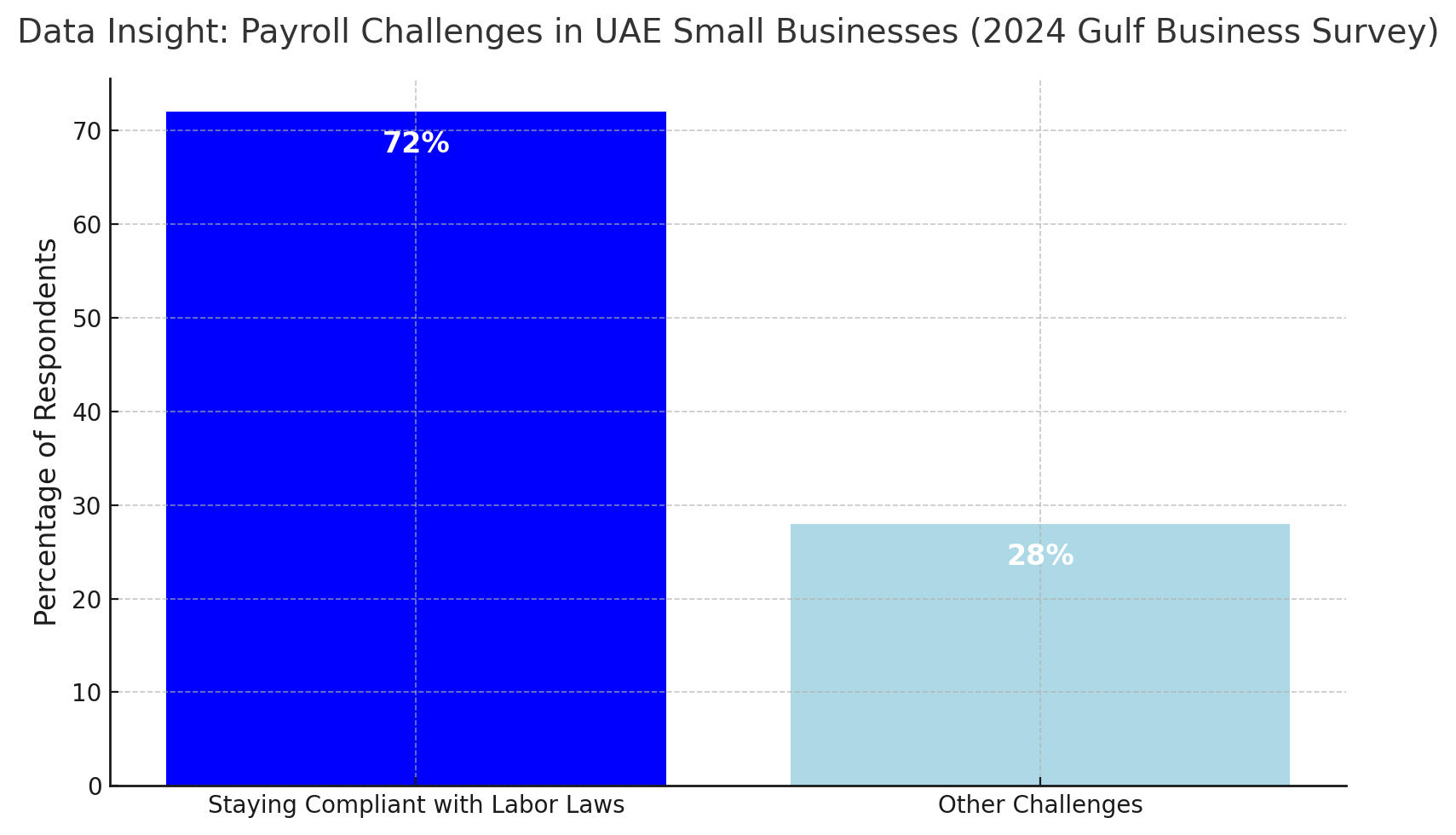

Data Insight: According to a 2024 Business Survey, 72% of small businesses in the UAE find staying compliant with labor laws one of their biggest payroll challenges.

- Manual Payroll Processes Lead to Errors

Despite significant advancements in payroll automation technology, many small businesses in the UAE continue to rely on manual payroll systems. While this might seem cost-effective in the short term, the hidden costs of inefficiency, errors, and compliance risks often outweigh any initial savings. Here’s a closer look at how manual processes can hinder small businesses:

Challenges of Manual Payroll Processes

- Increased Time Spent:

- Studies from 2024 show that small business owners spend an average of 8 hours per week on payroll processing. This includes tasks such as:

- Calculating wages and overtime.

- Tracking paid time off and benefits.

- Preparing year-end tax statements.

- For businesses with fewer employees, this time could be redirected toward core business activities, such as strategy, sales, or customer service.

- Studies from 2024 show that small business owners spend an average of 8 hours per week on payroll processing. This includes tasks such as:

- Higher Error Rates:

- Manual payroll systems are prone to human error, from miscalculating deductions to entering incorrect employee details. Common errors include:

- Incorrect overtime calculations.

- Inaccurate leave deductions.

- Misclassifications of employees (e.g., contractors vs. full-time staff).

- Studies from 2024, errors in payroll calculations lead to penalties averaging AED 20,000 annually, with some errors resulting in legal disputes.

- Manual payroll systems are prone to human error, from miscalculating deductions to entering incorrect employee details. Common errors include:

- Regulatory Compliance Challenges:

- The UAE’s Wage Protection System (WPS) requires precise calculations and timely payments. Errors in manual systems often lead to delays or inaccuracies in reporting, which can trigger fines ranging from AED 1,000 to AED 5,000 per violation.

- Keeping track of frequent updates to UAE labor laws is another burden for small businesses without automated systems.

- Stress on Business Owners:

- Small business owners often double as their company’s payroll managers. This added responsibility not only increases stress but also raises the likelihood of burnout, which can impact decision-making and overall business performance.

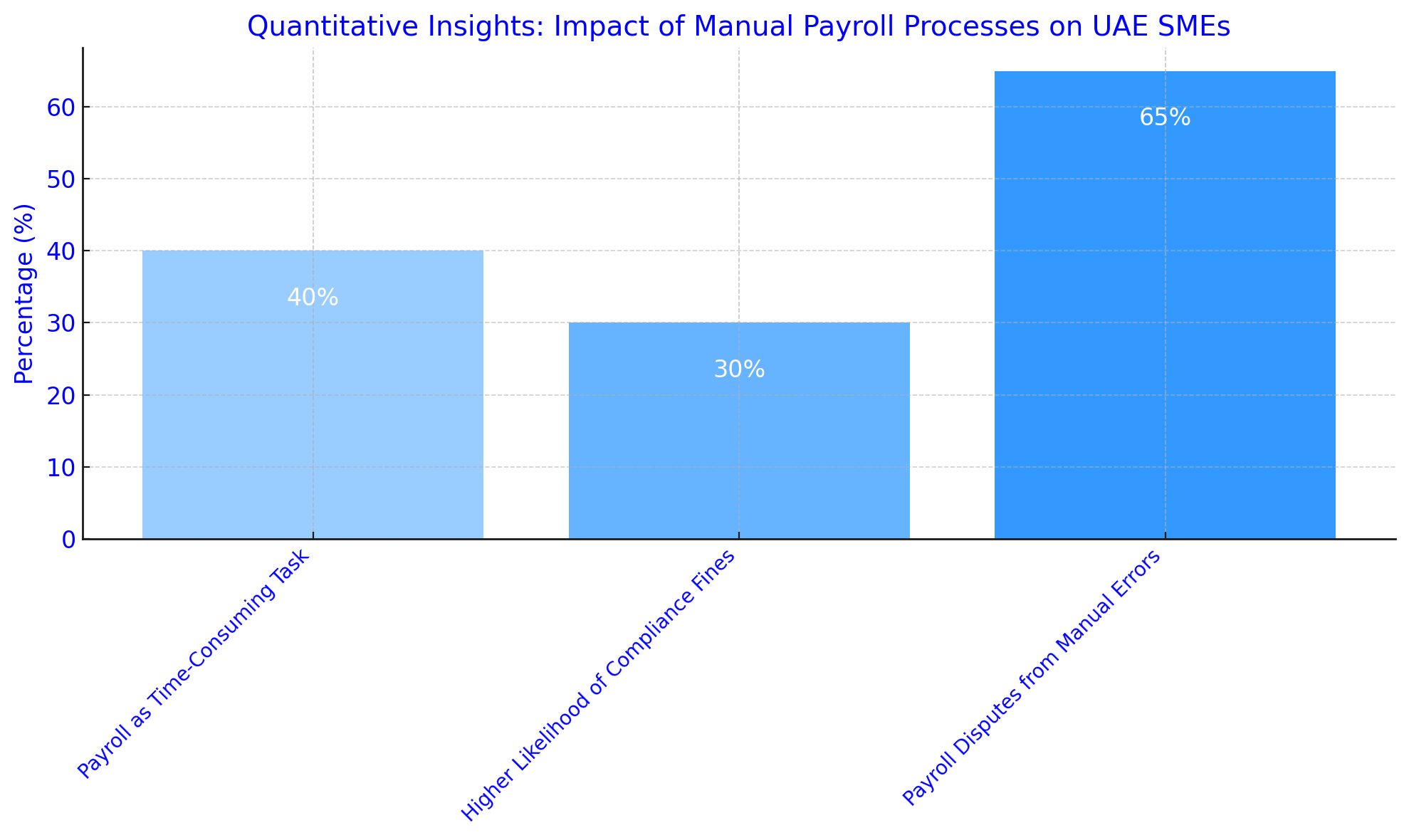

Quantitative Insights

Here’s a snapshot of the impact of manual payroll processes on UAE small businesses:

- 40% of SMEs in the UAE cite payroll management as their most time-consuming administrative task (Statista, 2024).

- Businesses using manual payroll systems report a 30% higher likelihood of compliance-related fines compared to those leveraging automated solutions.

- Over 65% of payroll disputes in small businesses are attributed to manual errors in wage calculations (UAE Labour Council, 2024).

Why Automation Is the Solution

Switching to automated payroll systems can resolve most of these issues by:

- Streamlining calculations and compliance reporting.

- Reducing human involvement, thus minimizing errors.

- Allowing for real-time updates to reflect regulatory changes.

Data Insight: According to a 2024 Deloitte UAE survey, businesses using automated payroll solutions reported a 50% reduction in payroll-related errors and saved up to 6 hours per week on administrative tasks.

Limited Resources for Specialized Payroll Management

Small businesses typically operate with constrained budgets and limited human resources:

- Lack of Expertise: In many cases, owners or general managers handle payroll without specialized knowledge, leading to errors.

- High Administrative Load: Tasks like generating pay slips, calculating bonuses, managing employee records, and preparing year-end reports consume substantial time that could otherwise be spent on business growth.

Data Insight: According to a 2025 Statista report, 43% of UAE SMEs cite payroll management as a critical bottleneck in their operations.

The Impact of Time-Consuming Payroll on Small Businesses

- Reduced Efficiency: Every hour spent on payroll is an hour not spent on growing the business. In a highly competitive market like Dubai, this lost time can directly affect profitability.

- High Turnover Risks: Payroll inaccuracies—such as delayed payments or incorrect deductions—can lead to employee dissatisfaction, which contributes to higher turnover rates.

- Regulatory Fines: With the UAE government enforcing stricter labor regulations, businesses failing to comply face fines of up to AED 50,000.

How Outsourcing Payroll Can Transform Your Business

Outsourcing payroll is no longer a luxury for small businesses in the UAE—it has become a strategic necessity. With the increasing complexities of compliance, employee expectations, and time constraints, outsourcing payroll can revolutionize your business operations, especially in a fast-paced market like Dubai.

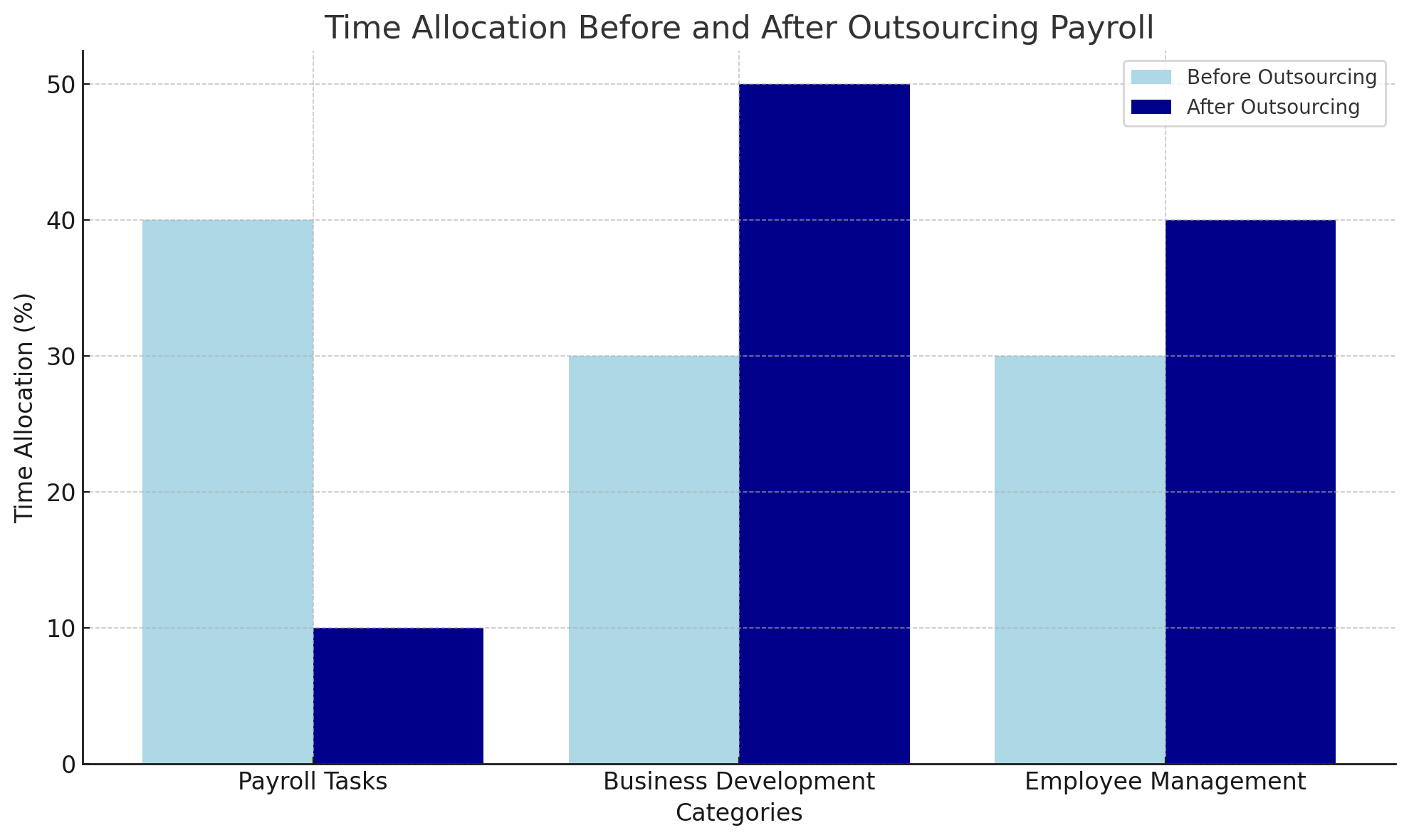

- Time Savings: Focus on Core Business Activities

- Payroll management is a time-consuming process, especially when done manually. Tasks like calculating salaries, taxes, deductions, and benefits can take hours every pay cycle.

- Outsourced payroll providers automate these processes, saving 30%–40% of time previously spent on payroll.

- The time saved can be redirected to core business activities like customer acquisition, product development, or market expansion.

Placeholder for Chart:

A chart showing time allocation before and after outsourcing payroll.

- Accuracy and Compliance

- Payroll errors are costly. Mistakes in calculations or regulatory filings can lead to fines and strained employee relations.

- Outsourcing ensures 99.5% accuracy by leveraging automated systems and professional expertise.

- Providers stay updated on UAE’s labor laws, such as the Wage Protection System (WPS) and Emiratization mandates, ensuring seamless compliance.

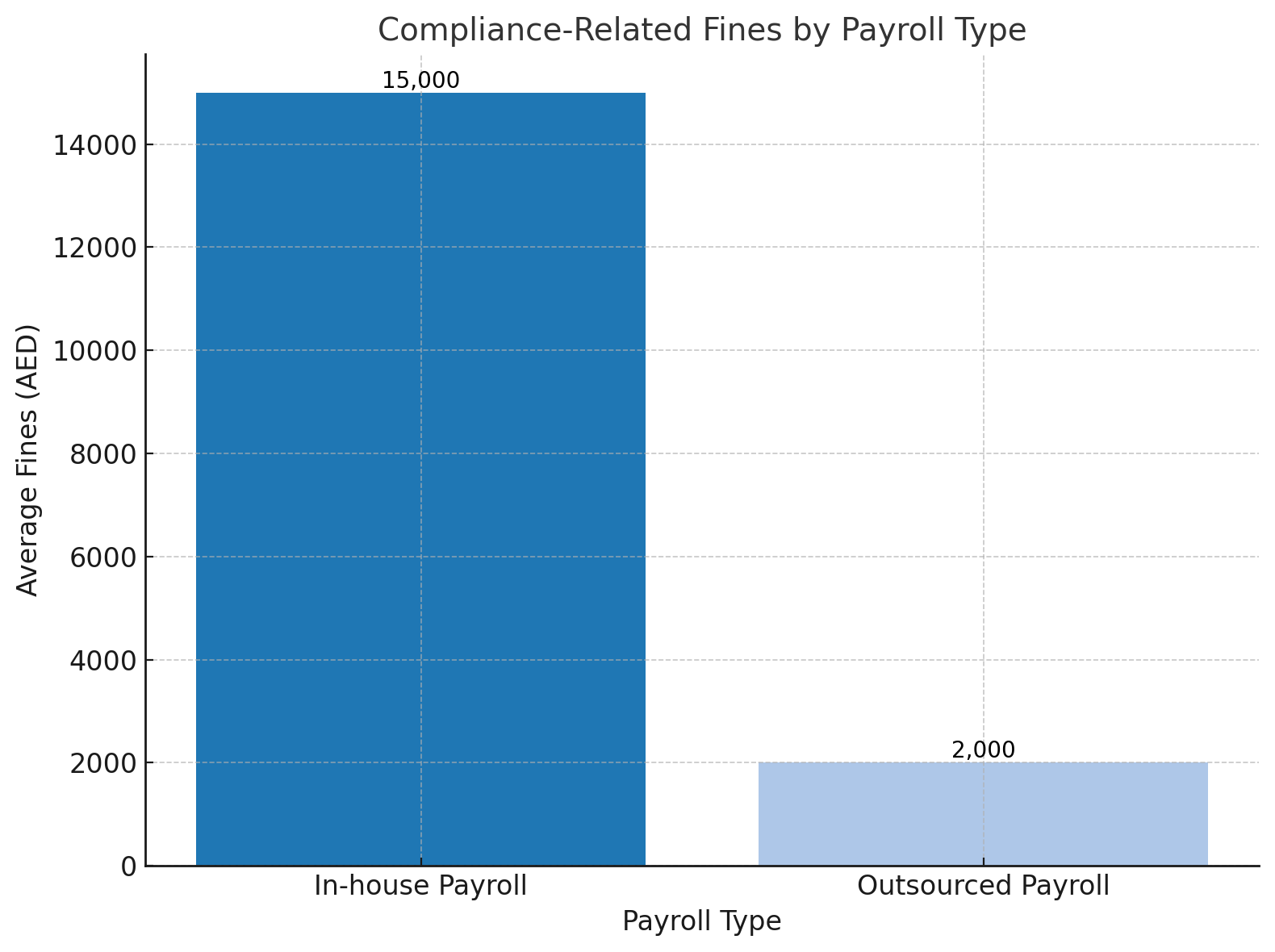

Key Fact:

A 2024 survey revealed that 55% of UAE businesses reduced payroll-related fines by outsourcing, saving an average of AED 15,000 annually.

Placeholder for Chart:

A bar chart comparing compliance-related fines.

- Cost Efficiency

- Hiring a full-time payroll manager in the UAE can cost AED 100,000–150,000 annually, depending on experience.

- Outsourcing payroll is significantly more affordable. Small businesses save up to 50% of payroll costs by opting for third-party providers.

- Providers also reduce hidden costs, such as those arising from tax filing errors or compliance audits.

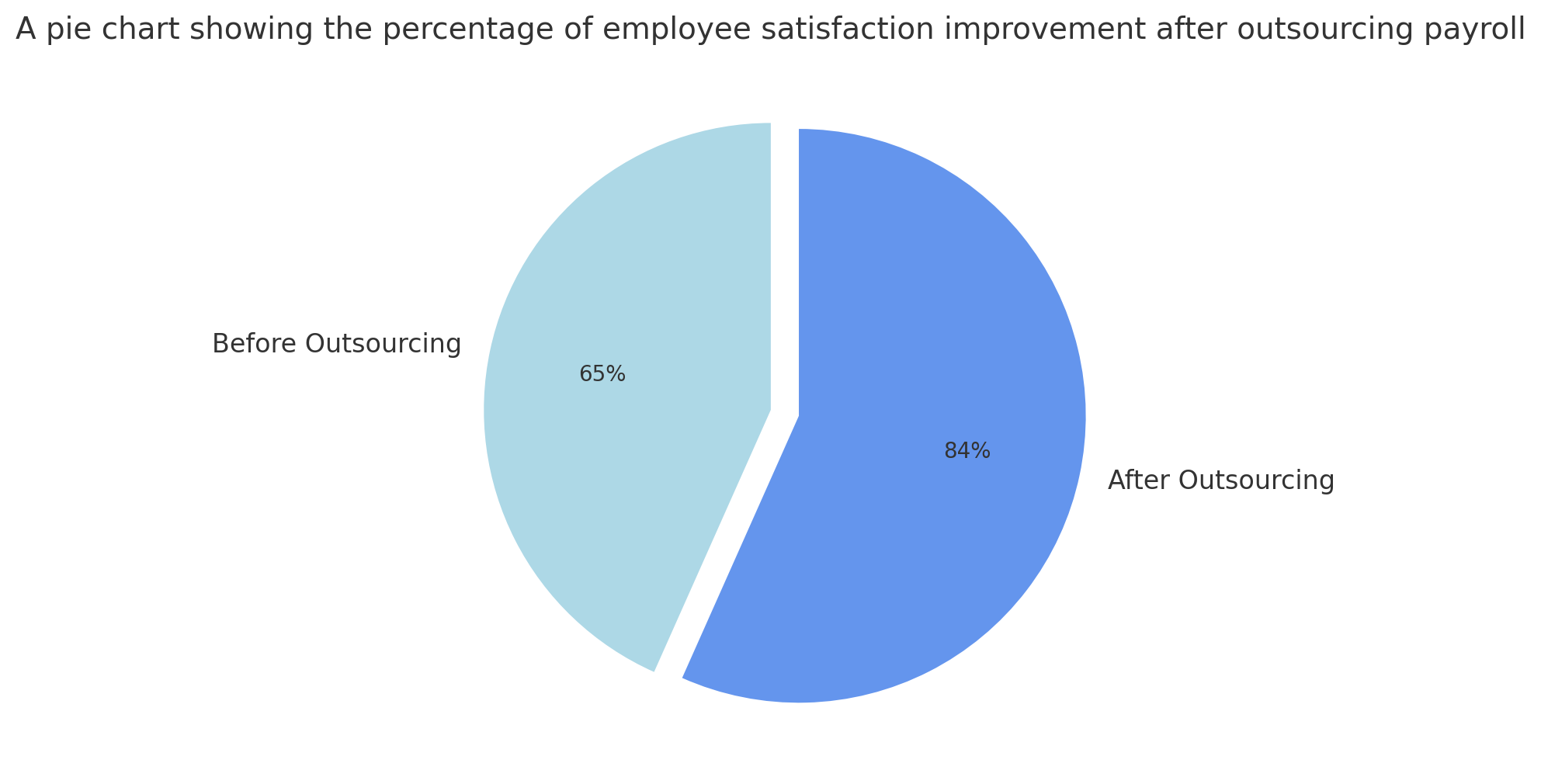

- Enhanced Employee Satisfaction

- Timely and accurate salary payments improve employee morale, leading to increased productivity and loyalty.

- Many outsourced providers offer employee self-service portals where staff can view pay slips, leave balances, and tax deductions.

- Transparent payroll practices reduce employee queries and build trust.

Placeholder for Chart:

A pie chart showing the percentage of employee satisfaction improvement after outsourcing payroll.

Why Small Businesses in Dubai Are Choosing Insights UAE

As a leader in payroll solutions, Insights UAE offers specialized services tailored to the unique needs of small businesses in Dubai. Here’s how they can help:

Comprehensive Payroll Management

- Full-service payroll processing, including WPS compliance and regulatory filings.

- Automated systems to ensure accuracy and efficiency.

Regulatory Expertise

- Insights UAE stays ahead of all changes in UAE labor laws, ensuring full compliance.

- The team proactively adapts payroll processes to reflect new regulations, such as Emiratization policies.

Customized Reporting

- Businesses receive detailed reports that break down payroll costs, taxes, and other key metrics to support financial planning.

Employee Portals

- A digital interface for employees to view pay slips, tax deductions, and other payroll-related data, improving transparency and trust.

- For small businesses in Dubai, managing payroll for small businesses doesn’t have to be a burden. By understanding the challenges and leveraging outsourced payroll services from trusted providers like Insights UAE, companies can reclaim their time, ensure compliance, and drive business growth.

FAQs:

What are the challenges of managing payroll for small businesses in the UAE?

Common challenges include compliance with WPS, adherence to dynamic labor laws, and avoiding errors in manual processing. These factors make payroll a time-intensive process.

How much time can outsourcing payroll save for small businesses?

Outsourcing payroll can save up to 40% of the time, allowing businesses to focus on growth and strategy (Statista, 2024).

What makes Insights UAE a trusted payroll provider?

Insights UAE offers end-to-end payroll solutions, regulatory expertise, and automation tools tailored to small businesses in Dubai.

How can payroll errors affect small businesses?

Payroll errors can lead to fines, employee dissatisfaction, and a damaged reputation. Automating payroll or outsourcing can minimize such risks.

Is outsourcing payroll cost-effective for small businesses?

Yes, outsourcing is cost-effective. It eliminates the need for full-time payroll staff, reduces errors, and saves time, leading to overall cost savings.

Source Links:

- https://www.cio.com/article/191229/sla-service-level-agreement-mistakes.html

- https://www.dli-it.com/hr-and-payroll-software-for-small-businesses-uae/

- https://edenred.ae/blog/payroll-processing-for-small-businesses/

- https://payrollmiddleeast.com/payroll-outsourcing-for-small-businesses-in-uae/

- https://endgrate.com/blog/saas-sla-management-best-practices-2024