The UAE has always been a hub for global business. From its soaring skyscrapers to its thriving industries, this region screams growth and opportunity. But what happens when businesses ignore the cracks beneath the surface? Financial risks are no longer just buzzwords, they’re the landmines waiting for businesses to step on. As we are about to exit 2024, ignoring them is a one-way ticket to collapse.

Recent data from 2024 financial reports shows a clear pattern: businesses that plan for risks survive, while those that don’t are forced to fold. According to the UAE Ministry of Economy, 70% of SMEs are now identifying liquidity risks as their biggest challenge. Combine that with global volatility, fluctuating oil prices, and tightening regulations, and you’ve got the perfect storm for financial instability.

What Makes Financial Risks So Dangerous?

Financial risks don’t announce their arrival. They sneak up silently and hit your cash flow, profit margins, and survival prospects. In 2024, these risks were multiplied as the economy faces a mix of local and global factors.

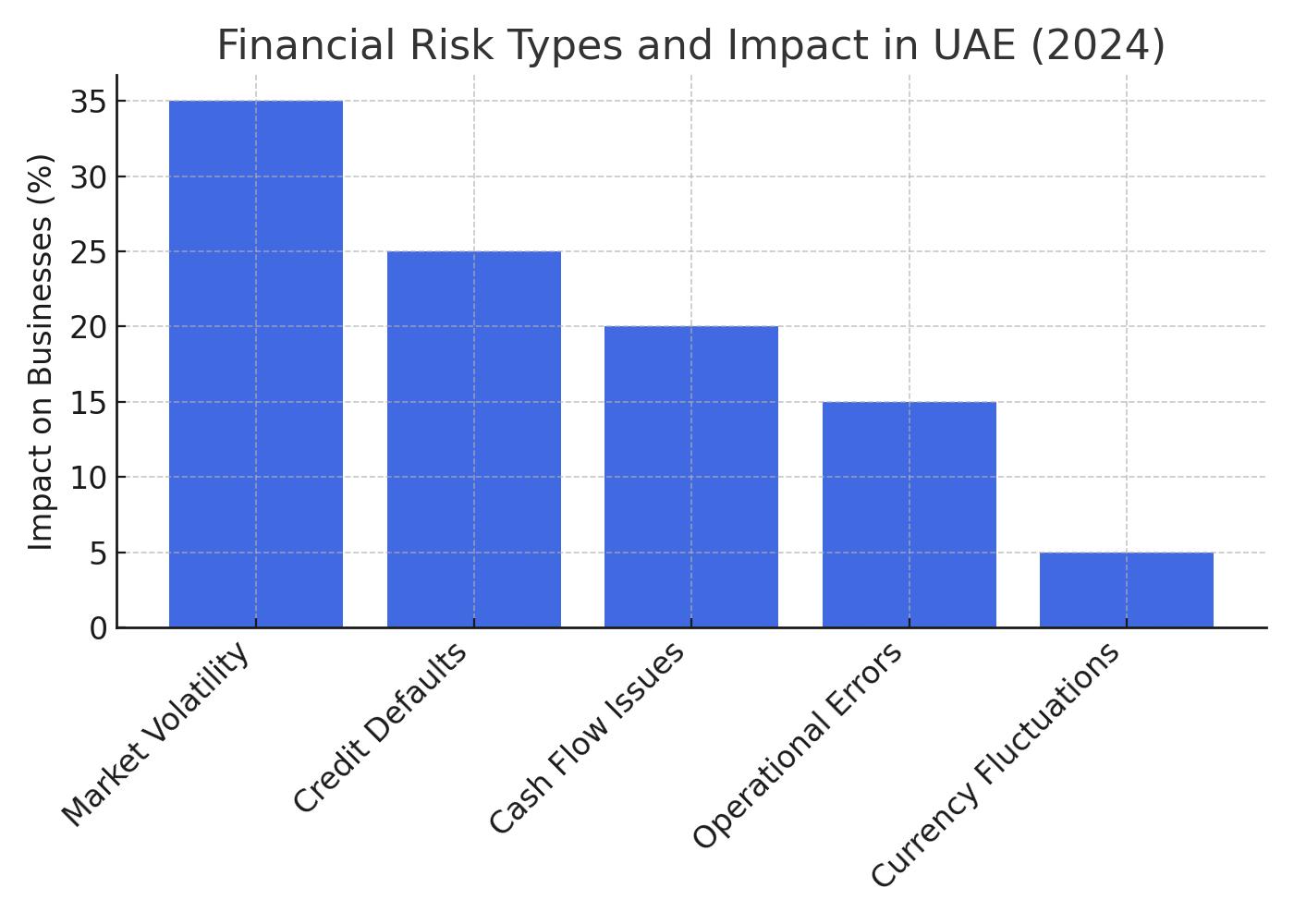

- Market Volatility: Economic uncertainty in oil prices, trade wars, and global inflation is driving unpredictable market movements. For UAE businesses, this volatility translates to inconsistent revenues and investment slowdowns.

- Cash Flow Crunch: According to UAE SME Report 2024, more than 45% of small businesses reported cash flow issues caused by delayed payments.

- Rising Debt Levels: Businesses expanding too quickly without proper financial buffers are increasingly defaulting on loans. UAE financial analysts project an 18% rise in SME loan defaults in 2024 compared to previous years.

- Global Ripples: Currency fluctuations and trade shifts are directly affecting imports and exports. With AED pegged to the USD, even minor dollar strengthening impacts UAE businesses that rely on international suppliers.

Why Were Financial Risks Are a 2024 Wake-Up Call for UAE Businesses

The UAE is no stranger to fast-paced economic growth, but growth without caution is risky business. In 2024, experts predicted that economic turbulence will hit harder. Here’s why businesses must act now:

- SME Vulnerability Is at an All-Time High: The UAE’s economy relies on SMEs, but they remain the most exposed to financial risks. Recent reports indicate that 80% of SMEs lack proper financial risk management systems, leaving them vulnerable to cash shortages.

- Dependency on Oil and Real Estate: While diversification is a priority under the UAE Vision 2030, oil prices still dictate the pulse of the economy. A drop in prices can lead to significant ripple effects across logistics, construction, and manufacturing.

- Increasing Operational Costs: Businesses face rising operational expenses, from office rentals in Dubai to importing raw materials. Combined with delayed payments, companies are bleeding cash faster than they can recover.

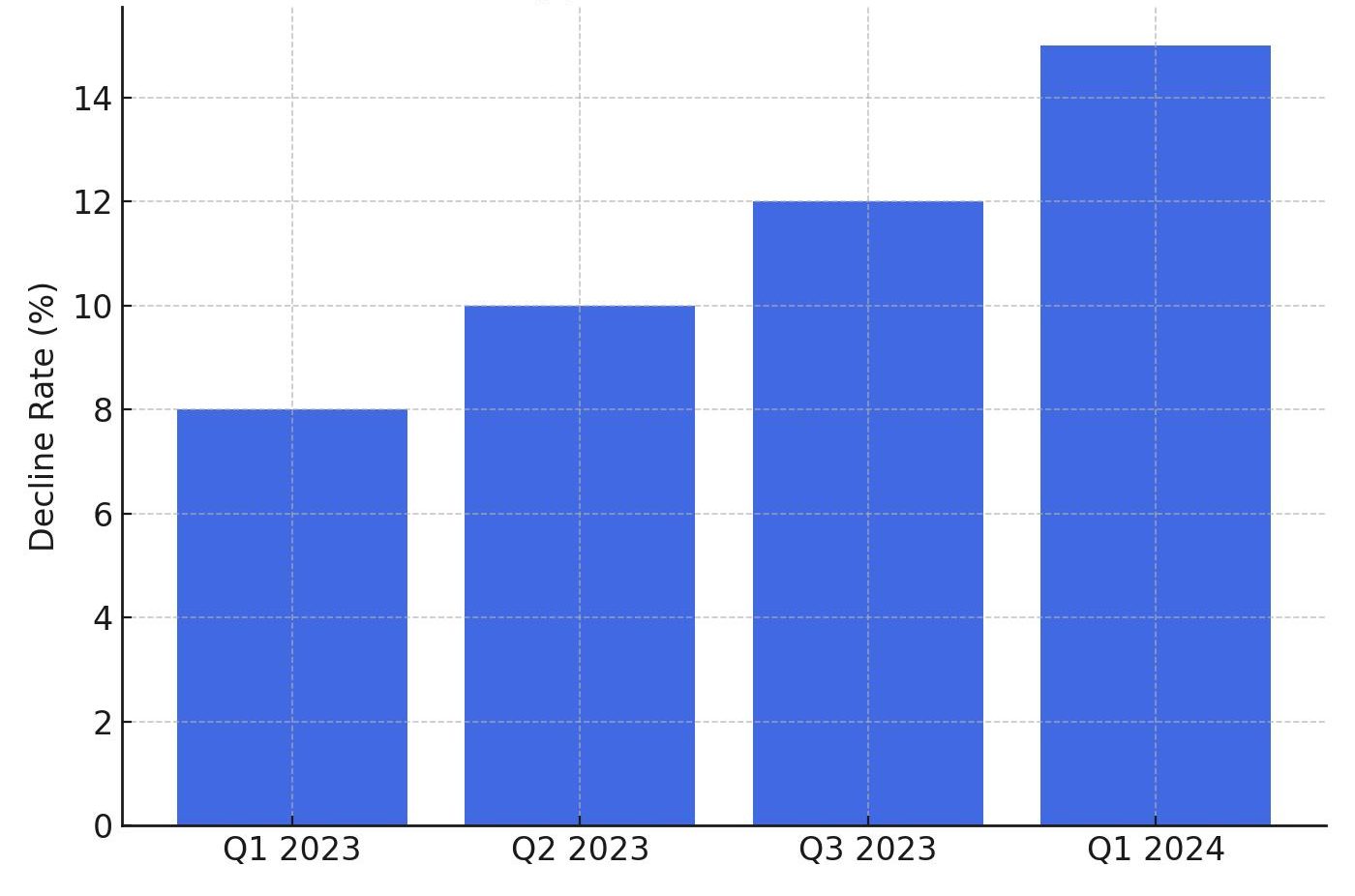

- The Credit Crunch: Access to credit is becoming tighter for small businesses. UAE’s leading banks reported a 12% decline in SME loan approvals in Q1 2024, further compounding liquidity challenges.

From Collapse to Survival: The Solution Playbook

If you’re feeling the pressure, good. Financial risks demand proactive planning. Here’s how UAE businesses can weather the storm and come out stronger:

Focus on Liquidity Management

Cash is king, especially in volatile markets. Businesses need to maintain healthy cash flow reserves. Experts recommend building 6-12 months’ worth of operating expenses to cushion against financial shocks. For SMEs, this means tracking every dirham and plugging revenue leaks quickly.

Diversify Revenue Streams

Relying on a single client, product, or market is asking for trouble. UAE businesses that diversify into sectors like renewable energy, e-commerce, and FinTech are outperforming those stuck in legacy industries. Diversification isn’t optional; it’s survival.

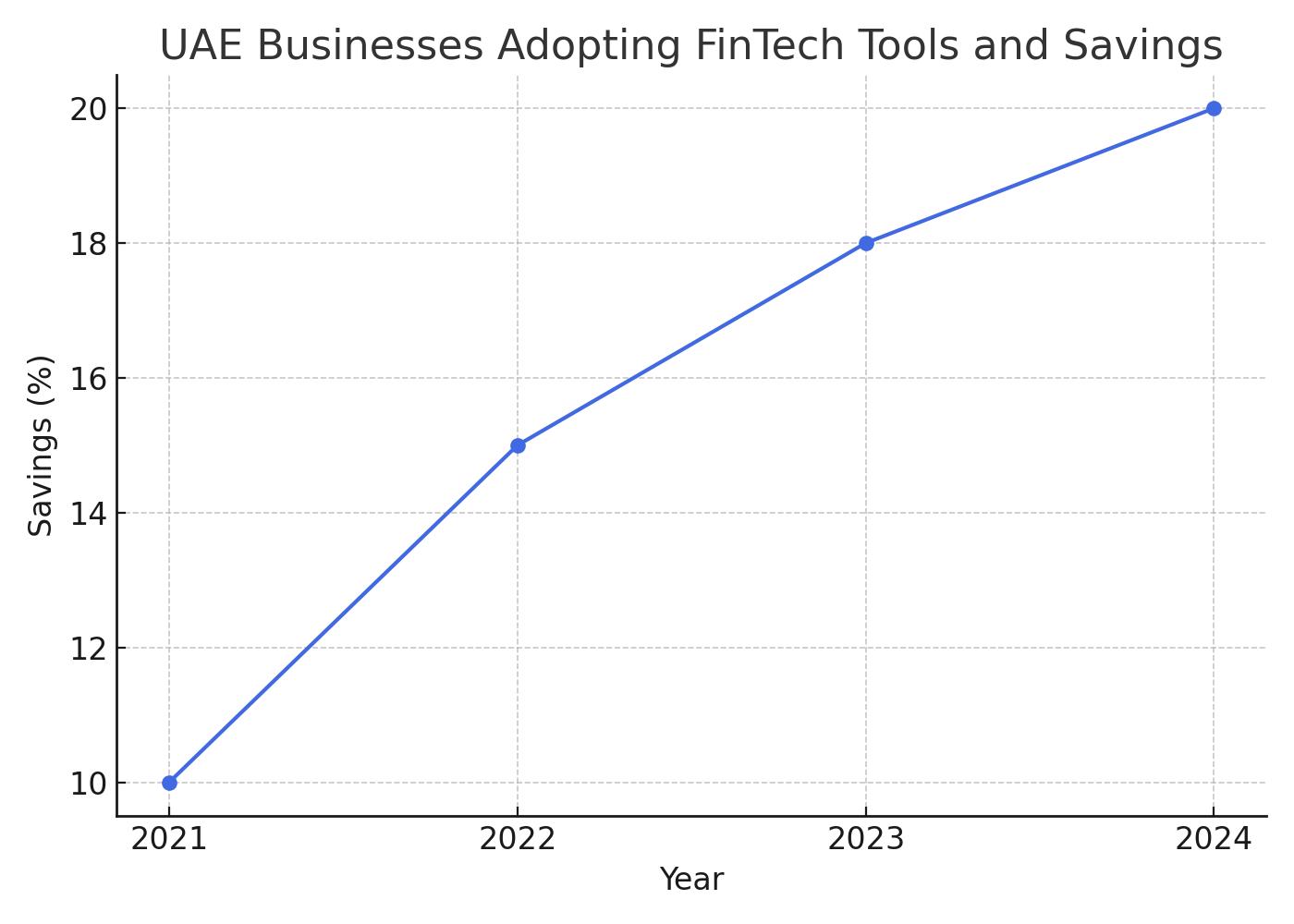

Leverage Financial Technology (FinTech)

FinTech tools in the UAE are revolutionizing financial planning. From AI-based cash flow prediction software to automated invoicing, businesses can track risks in real-time. According to FinTech UAE 2024, over 60% of businesses that adopted financial tools reported a 20% reduction in cash flow issues.

Build Resilient Credit Policies

Don’t let delayed payments choke your business. Implement stricter credit terms, conduct background checks on clients, and stagger payments to minimize credit risk. Companies that improved their credit management saw a 30% improvement in cash flow within six months.

Audit Your Risks Regularly

Risk assessments aren’t just for banks. Businesses need to conduct quarterly financial audits to spot issues before they snowball. Invest in professional services or AI-driven tools to identify and prioritize risk factors.

Inflationary Pressures and Cost Escalation

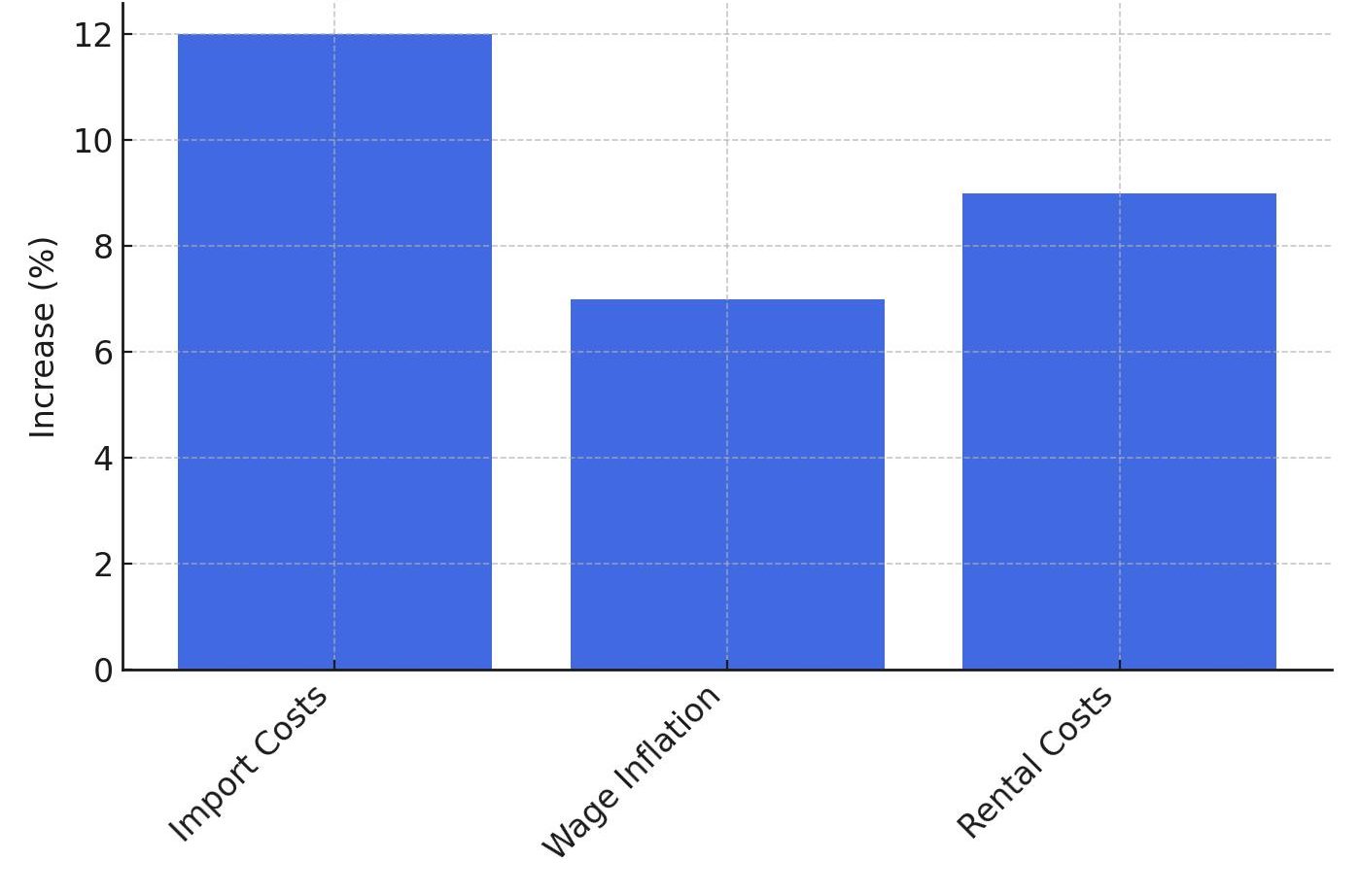

Inflation might not be hitting the UAE as hard as other markets, but it’s still a concern. Rising costs of goods, wages, and energy are eating into profits:

- Import Costs: Inflation-driven supply chain disruptions increased import costs by 12% for UAE businesses in 2024.

- Wage Inflation: Salary demands are rising across sectors, with an average wage increase of 7% in 2024 to attract and retain talent.

- Rental Costs: Commercial rental rates in Dubai and Abu Dhabi have risen by 8-10%, adding to the operational strain on SMEs and mid-sized enterprises.

Businesses that fail to account for inflationary pressures risk pricing themselves out of the market or seeing shrinking margins as costs outpace revenues.

UAE Companies That Took Financial Risks Seriously & thrived

- Emirates Airlines

By hedging fuel costs during market volatility, Emirates Airlines saved millions of dollars and stabilized operating expenses. Their proactive financial risk management ensured profitability even during turbulence.

- Noon

Noon, the UAE’s e-commerce leader, adopted FinTech tools to manage its vast supply chain expenses. By automating payments and tracking real-time spending, Noon reduced operational costs by 15% in 2023.

- Bee’ah

Bee’ah diversified into waste-to-energy projects, ensuring consistent revenue regardless of market slowdowns. Their ability to innovate has solidified them as a leader in sustainable infrastructure.

The 2024 Business Takeaway: Financial Risks Are Non-Negotiable

In 2024, the message was clear: UAE businesses cannot afford to ignore financial risks. From cash flow crunches to credit defaults, the threats are real, but so are the solutions. Companies that prioritize liquidity, diversify revenue, and adopt FinTech tools will not only survive but thrive. Businesses that fail to act? Well, let’s just say the headlines won’t be pretty.

Closing the Gaps: Practical Financial Strategies for UAE Businesses

Surviving in 2024 means being smarter, faster, and more resilient. Here’s a quick recap of actionable strategies:

- Leverage AI Tools: Automate financial tracking, risk forecasting, and cash flow management to reduce errors and delays.

- Diversify Operations: Enter new markets, adopt sustainable practices, and explore tech-driven solutions.

- Reduce Operational Waste: Invest in process improvements and resource-efficient technologies to cut costs.

- Monitor Inflation Trends: Adjust pricing models and optimize supplier agreements to absorb rising costs without sacrificing margins.

- Conduct Risk Audits: Regularly assess credit, market, and liquidity risks to stay ahead of disruptions.

By focusing on financial agility and proactive planning, businesses can transform risks into growth opportunities, ensuring a stronger and more resilient future.

How Insights UAE Can Help You Stay Ahead in 2025

At Insights UAE, we turn financial challenges into strategic opportunities. Here’s how we help UAE businesses future-proof their finances:

- Risk Audits and Analytics: In-depth assessments to identify vulnerabilities in cash flow, credit, and market exposure.

- Custom Financial Solutions: Tailored strategies to diversify revenue and minimize risks.

- FinTech Integration: Cutting-edge tools for real-time cash flow tracking and predictive financial planning.

- Expert Workshops: Training your team to identify risks and act proactively.

- Ongoing Support: Continuous monitoring and reporting to keep your finances healthy.

With Insights, financial risks stop being threats and start being opportunities. Ready to make 2025 your most resilient year yet? Let’s get started.