Navigating the world of actuarial valuation for end of service benefits (EOSB) can feel like solving a Rubik’s cube in the dark. Why bother, you ask? Because EOSB liabilities in the UAE are a big deal—as in AED 13 billion big, based on estimates from 2024. That’s some serious cash you don’t want to fumble.

So, let’s break it down. Here are the five crucial methods for actuarial valuation of end of service benefits, complete with insights, questionable practices to avoid, and solution-oriented technical tips.

The Big Picture: Why Actuarial Valuation of End of Service Benefits Matters

End of service benefits in the UAE aren’t just corporate fluff; they’re mandatory. The average payout per employee rose to AED 65,000 in 2024, reflecting the UAE’s evolving labor market. Ignoring EOSB liabilities is like ignoring a leaky roof—it’ll cost you more later.

Actuarial valuation ensures you:

- Stay Legally Compliant: Meet the UAE’s labor laws, which are stricter than ever.

- Plan Financially: Accurately account for liabilities and prevent fiscal shocks.

- Support Employee Retention: Employees are watching; good benefits build loyalty.

- Avoid Surprise Costs: A solid plan means no sudden financial headaches.

But which method should you choose? Let’s dig into the top five.

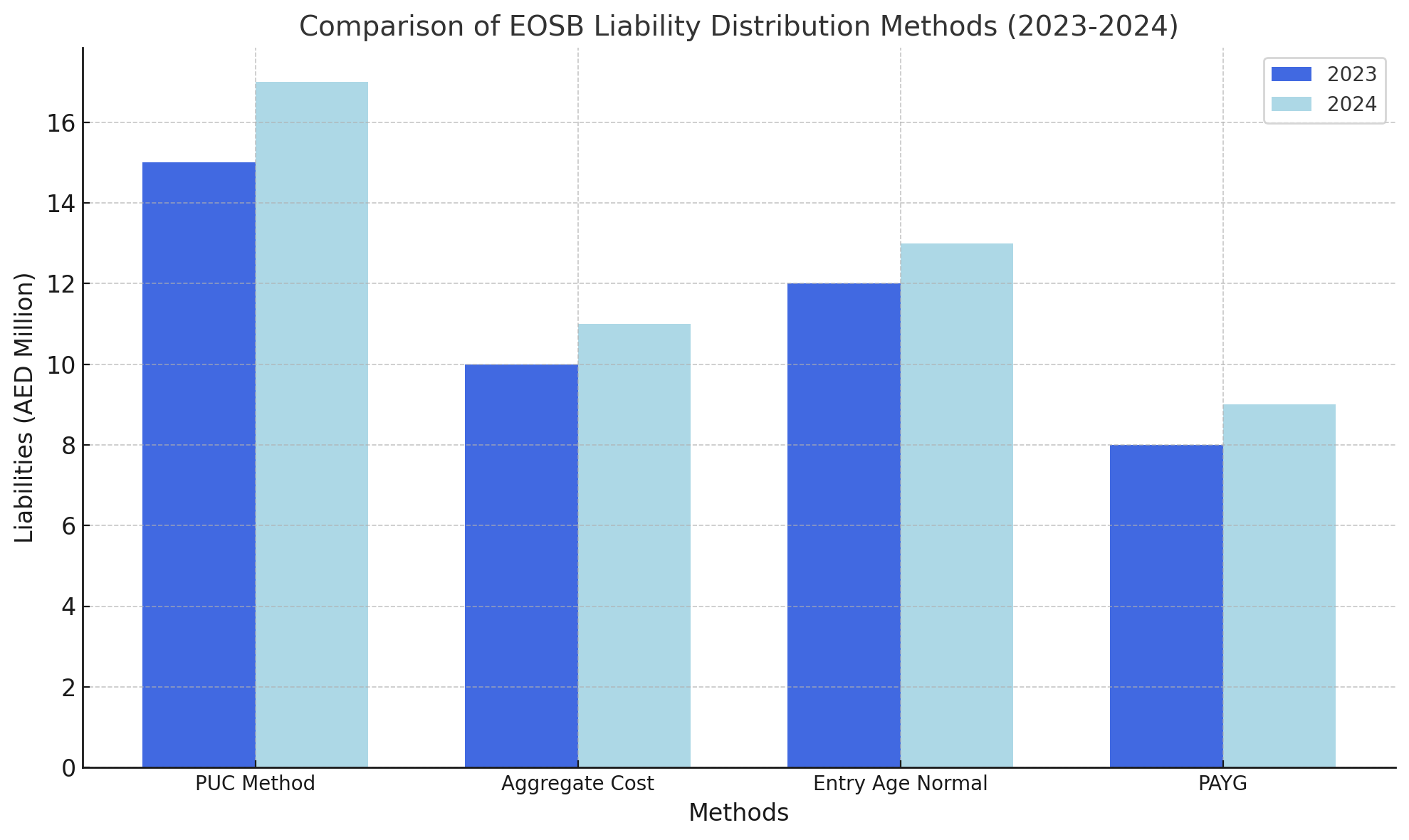

Method 1: Projected Unit Credit (PUC) Method

The Projected Unit Credit (PUC) method is the cornerstone of EOSB actuarial valuation. It divides an employee’s benefits into annual accruals and projects their future value at the point of retirement. Here’s how it works in more detail:

Core Components of the PUC Method

- Annual Salary Growth: In 2024, UAE salary growth averaged 5.3%, a crucial input for projecting EOSB liabilities. The PUC method anticipates future salary increments, factoring them into the benefits calculation.

- Service Period: This method evaluates accrued benefits proportionate to the employee’s tenure. For instance, an employee with five years of service would have EOSB accruals based on their annual benefit entitlement multiplied by five.

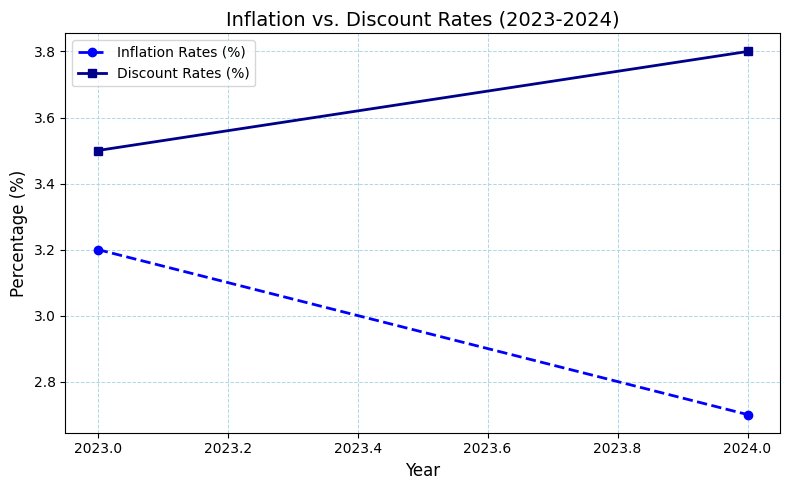

- Discount Rate: Future liabilities are discounted back to their present value using a reliable discount rate. The UAE’s average discount rate in 2024 stood at 3.8%, directly impacting the valuation results.

- Inflation Adjustment: Inflation, which averaged 2.7% in 2024, plays a significant role in accurately predicting future benefit payouts.

Advantages of the PUC Method

- Precision: By linking benefits to tenure and salary projections, the PUC method offers a clear snapshot of liabilities.

- Flexibility: It’s scalable for both small firms and multinational corporations.

- Compliance: The method aligns with International Financial Reporting Standards (IFRS), ensuring global acceptance.

Challenges to Consider

- Data Dependency: High-quality employee data is a must. Missing or inaccurate records can lead to skewed results.

- Economic Volatility: Fluctuations in discount rates or inflation can introduce uncertainty, demanding frequent updates.

Practical Application Example

Imagine a company with 200 employees, each earning an average salary of AED 150,000. Using the PUC method:

- Annual Accrual per Employee: AED 8,250 (based on 5.5% of the salary per year).

- Total Annual Liability: AED 1.65 million.

- Projected EOSB in 10 Years: AED 16.5 million, discounted at 3.8%.

Method 2: Aggregate Cost Method

The Aggregate Cost Method is a straightforward and systematic approach to determining EOSB liabilities. It pools together all liabilities and spreads them evenly across all employee’s remaining service periods. Here’s how it works:

Core Components of the Aggregate Cost Method

- Liability Pooling: Unlike individual methods, this approach aggregates total liabilities for the workforce. For example, if a company has 100 employees with cumulative EOSB liabilities of AED 10 million, the entire amount is treated as a single pool.

- Service Period Division: The total liability is divided across the estimated years remaining until the last employee retires or leaves. If the average remaining tenure is 10 years, the annual allocation would be AED 1 million.

- Uniform Distribution: This method assumes an equal allocation of liabilities each year, simplifying financial forecasting.

Advantages of the Aggregate Cost Method

- Simplicity: The uniform distribution of liabilities makes it easy to understand and implement.

- Resource Efficiency: Requires fewer computational resources compared to detailed, individual-based methods.

Challenges to Consider

- Lack of Flexibility: This method doesn’t account for individual employee variations, such as differing tenures, salary growth, or resignation patterns.

- Underestimating Liabilities: With a 4.2% workforce growth rate in the UAE in 2024, this method risks underestimating future liabilities, especially in expanding organizations.

- Economic Sensitivity: Assumes steady economic conditions, which may not hold true in fluctuating markets.

Practical Application Example

Consider a mid-sized UAE company with:

- Cumulative EOSB Liability: AED 12 million.

- Average Remaining Employee Tenure: 8 years.

- Annual Liability Allocation: AED 1.5 million.

This approach provides a predictable annual cost but could result in discrepancies if turnover increases or salary increments accelerate.

Method 3: Entry Age Normal Cost Method

The Entry Age Normal Cost Method stands out for its systematic and equitable approach. Unlike other methods that focus solely on current liabilities or future projections, this method spreads the cost of EOSB liabilities uniformly over the total expected working years of an employee. By distributing costs evenly, it creates a predictable financial framework.

This method calculates the present value of EOSB benefits employees will accrue by the end of their careers and allocates that value into equal annual contributions over their service period. For instance, if an employee is hired at age 30 and is expected to retire at age 60, the total EOSB liability is divided by the 30 years of expected service. Each year, a fixed amount is allocated to meet the liability.

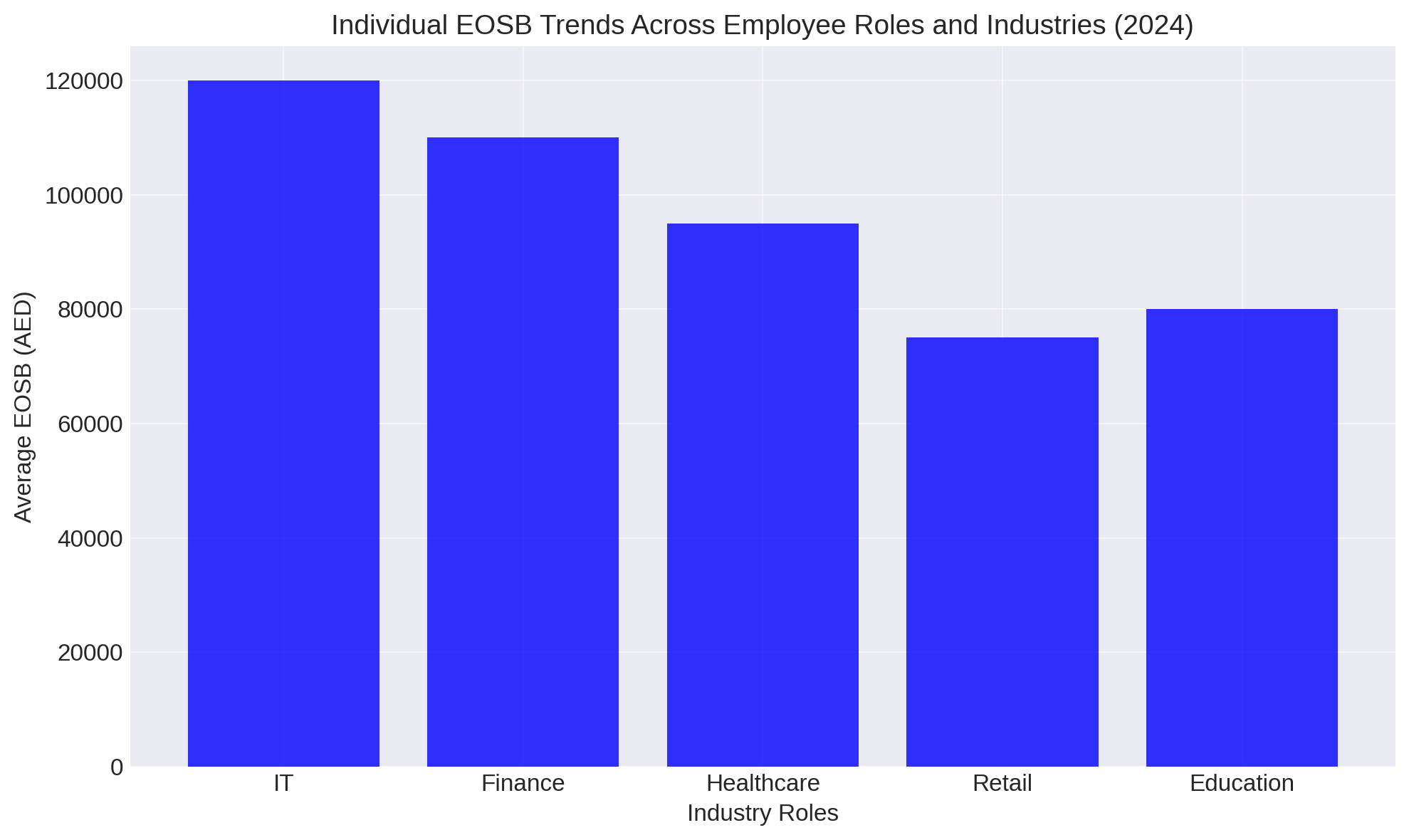

In 2024, this method gained traction in the UAE’s education and healthcare sectors due to their typically low employee turnover rates and long service durations. Employers in these industries found the Entry Age Normal Cost Method’s even cost distribution aligned well with their stable operational models.

However, this method is not without challenges. It requires accurate forecasting of salary progression and employee retention. The UAE’s average employee retention of 4.8 years may differ significantly in high-turnover industries, making the method less effective there. Furthermore, this method assumes constant salary growth, which might not reflect the economic realities of 2025’s evolving market.

In terms of practical implementation, companies adopting the Entry Age Normal Cost Method must rely on sophisticated actuarial software and regular reviews. A mid-sized company with 150 employees could project a liability of AED 9 million over 20 years, resulting in an annual allocation of AED 450,000. This predictable expense helps in smoother financial planning.

Method 4: Pay-As-You-Go Method (PAYG)

This is the “wing it” method of EOSB. You pay benefits as they come due. There is no forecasting, no prep—just cold, hard cash on demand.

Why it works: Minimal upfront effort.

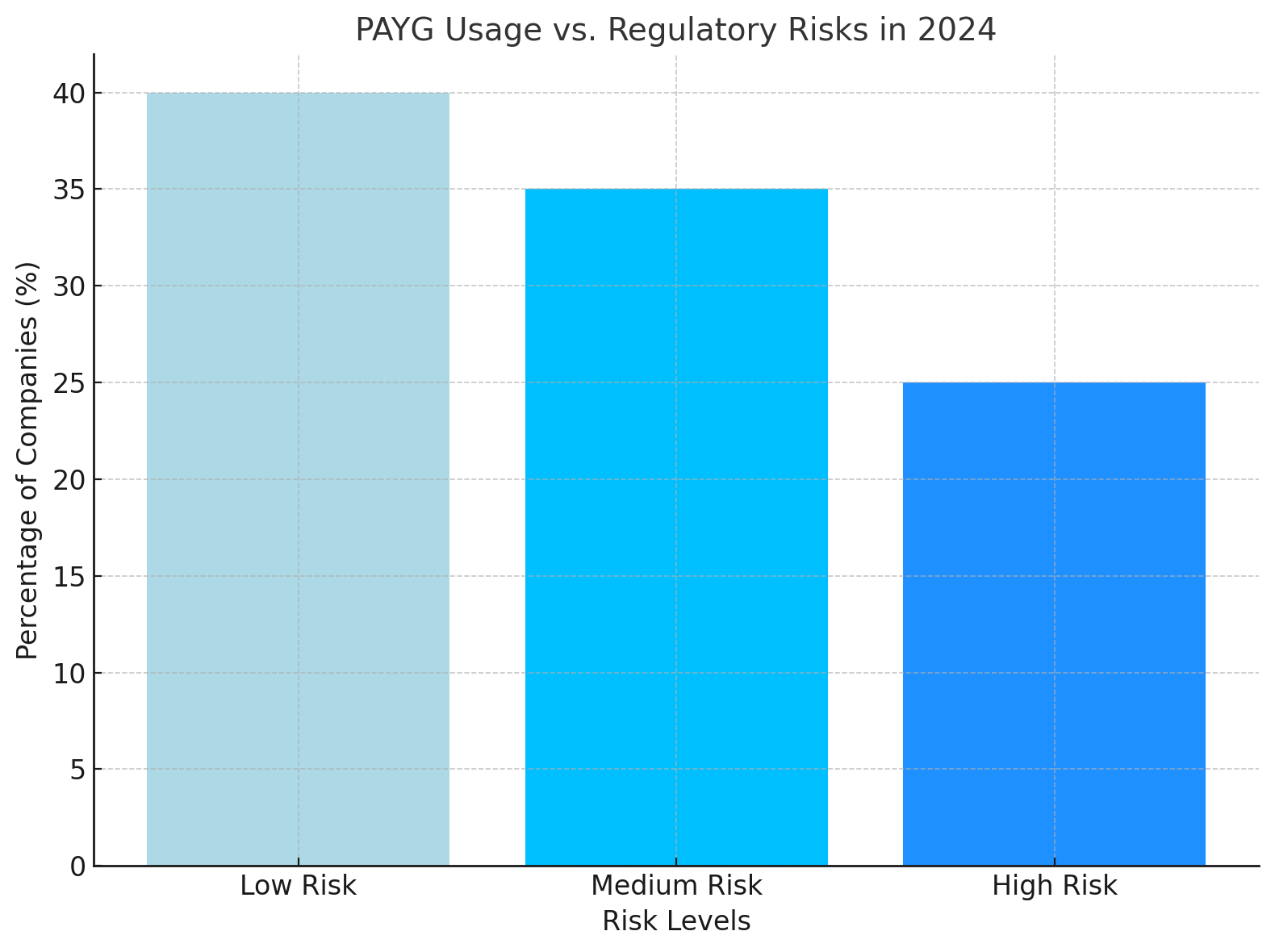

Why it’s risky: In 2024, over 12% of UAE companies reported cash flow issues due to unplanned EOSB payouts. This method is a ticking time bomb if you’re not careful.

Regulatory Alert: UAE authorities are tightening the screws on firms defaulting on EOSB. The fines alone could sink smaller businesses.

Method 5: Individual Accruals Method

The Individual Accruals Method is the most granular and accurate approach for calculating EOSB liabilities. Each employee’s benefits are calculated individually, taking into account their tenure, salary history, expected salary progression, and role-specific factors. This ensures the valuation reflects real-time variations and provides unparalleled precision.

This method is particularly valuable in industries with specialized workforces, such as technology and finance, where employees have unique career trajectories and salary benchmarks. For example, an IT professional with 10 years of service and consistent salary hikes requires a distinctly different calculation than a retail worker with similar tenure but a steady salary.

However, precision comes at a cost. The Individual Accruals Method is data-intensive and demands robust HR systems capable of tracking detailed employee information. For larger organizations, applying this method can feel like orchestrating a symphony with hundreds of instruments—meticulous but rewarding.

Advantages of the Individual Accruals Method

- Precision: Tailors calculations to each employee, minimizing overestimations or shortfalls.

- Adaptability: Handles workforce diversity, accommodating variations in roles, salaries, and tenures.

- Transparency: Facilitates clear communication with stakeholders, as each liability is accounted for explicitly.

Challenges of Implementing This Method

- Resource-Intensive: Requires substantial time and expertise, especially for companies with 500+ employees.

- System Dependence: Relies on comprehensive and accurate data management systems to avoid calculation errors.

- Regulatory Complexity: Careful compliance checks are needed to align with evolving labor laws in the UAE.

Practical Example

Consider a UAE-based fintech company with 300 employees:

- Total EOSB Liability: AED 18 million.

- Average Salary Increment: 7% annually for mid-level roles.

- Time Investment: Approximately 20% more time is spent on calculations compared to aggregate methods.

By adopting the Individual Accruals Method, the company achieves tailored insights into liability distribution, aiding in budgeting and compliance.

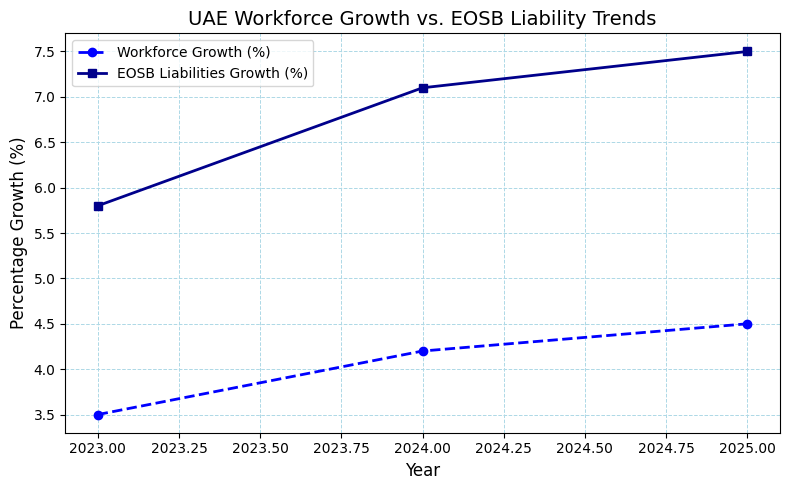

Common Challenges in 2024 and Expected in 2025

The landscape of EOSB in the UAE has always been dynamic, but 2024 presented some unique hurdles that are expected to evolve further in 2025:

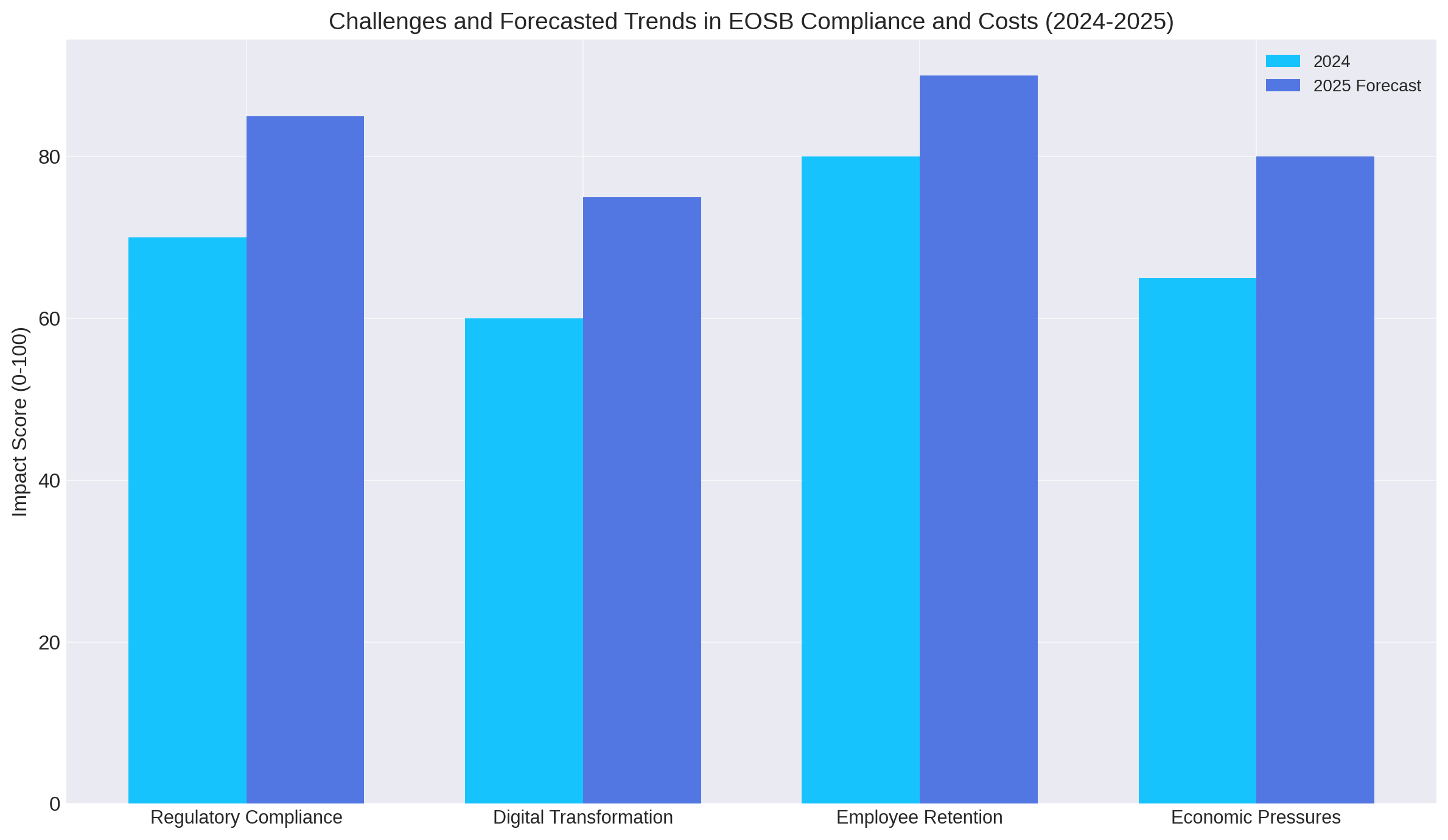

- Regulatory Flux: In 2024, stricter labor laws demanded meticulous compliance, including timely submissions of actuarial valuations. These changes are likely to intensify in 2025, with penalties for non-compliance expected to rise.

- Economic Pressures: Although global inflation eased to 4.7% in 2024, businesses in the UAE still faced elevated operating costs. 2025 could bring further challenges as companies adapt to fluctuating exchange rates and shifting oil prices, which directly impact financial planning.

- Employee Expectations: End of service benefits are increasingly viewed as a cornerstone of employee satisfaction. In 2024, millennials and Gen Z workers in the UAE prioritized comprehensive benefits over base salaries. In 2025, this trend is expected to deepen, placing more pressure on organizations to offer competitive packages.

- Digital Transformation Challenges: With a growing emphasis on integrating HR tech for EOSB calculations, companies in 2024 struggled with system adoption and training. The pace of digital transformation will likely accelerate in 2025, adding complexity for those lagging behind.

How Insights UAE Can Help

Feeling overwhelmed? Don’t worry. At Insights UAE, we specialize in turning EOSB chaos into clarity. Here’s how we can help:

- Custom Solutions: Tailored to your workforce, industry, and financial goals.

- Data-Driven Models: Using the latest UAE-specific trends, including inflation and retention rates.

- Regulatory Compliance: Stay ahead of the game with expert guidance.

- Workforce Analytics: Optimize your EOSB strategies with actionable insights.

We helped over 200 UAE businesses navigate EOSB complexities in 2024. Let us do the same for you.

Wrapping It Up

Actuarial valuation of end of service benefits isn’t just technical jargon; it’s a game-changer for your business. The right method can mean the difference between smooth sailing and financial shipwreck.

So whether you’re a startup or a corporate giant, don’t leave EOSB to chance. And remember, Insights UAE is just a call away to help you master this critical area. Together, we’ll make 2025 your smoothest year yet.