Payroll management is a critical function for organizations in the UAE, regardless of size. Managing payroll services for one employee can be challenging due to the unique regulatory and compliance landscape in the UAE. Adhering to labor laws, tax regulations, and administrative requirements is essential to avoid penalties, reputational damage, and inefficiencies. This article highlights why managing payroll services for one employee in the UAE can lead to compliance issues and the measures businesses can take to address them.

Common Compliance Challenges in UAE Payroll Management

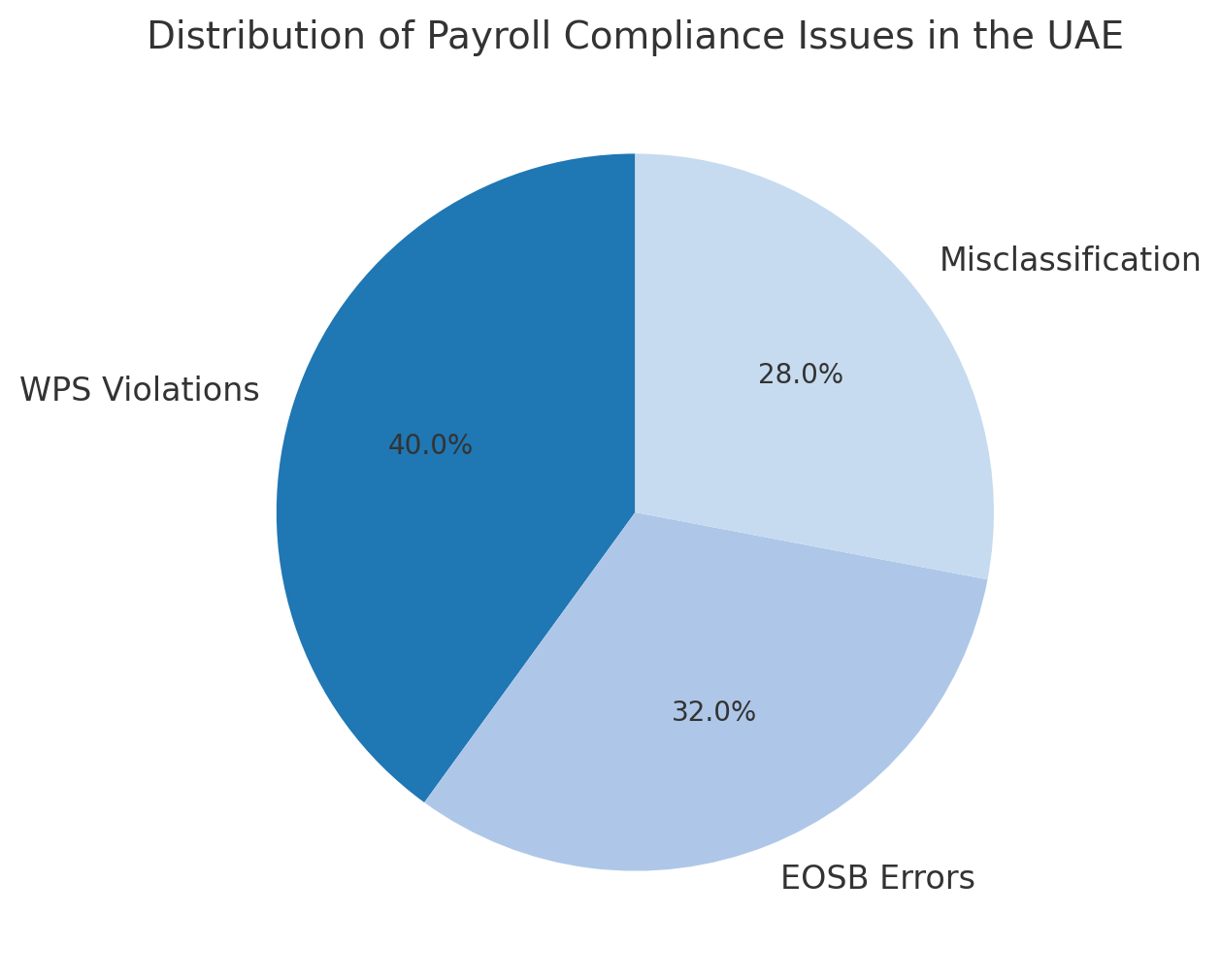

One of the most significant challenges in payroll services for one employee in the UAE is compliance with local labor laws, such as the UAE Labour Law and the Wages Protection System (WPS). Businesses must ensure accurate salary payments through WPS to avoid penalties. According to MOHRE data from 2023, approximately 15% of SMEs in the UAE were fined for non-compliance with WPS regulations, leading to collective penalties exceeding AED 50 million.

End-of-Service Benefits (EOSB) calculations add complexity. A PwC study in 2024 found that errors in gratuity calculations were the most common payroll issue for SMEs, accounting for 32% of payroll-related disputes in the UAE.

Accurate record-keeping is also essential. UAE labor law mandates businesses to retain payroll records for up to five years. However, a 2023 survey revealed that 40% of small businesses struggled with record management, increasing the risk of audits and penalties.

The Impact of Payroll Non-Compliance in the UAE

Non-compliance with UAE payroll laws has severe consequences. For instance, organizations failing to comply with WPS requirements face penalties starting from AED 1,000 per violation, along with potential business bans. Gratuity disputes often lead to lengthy and costly legal proceedings, damaging a company’s reputation.

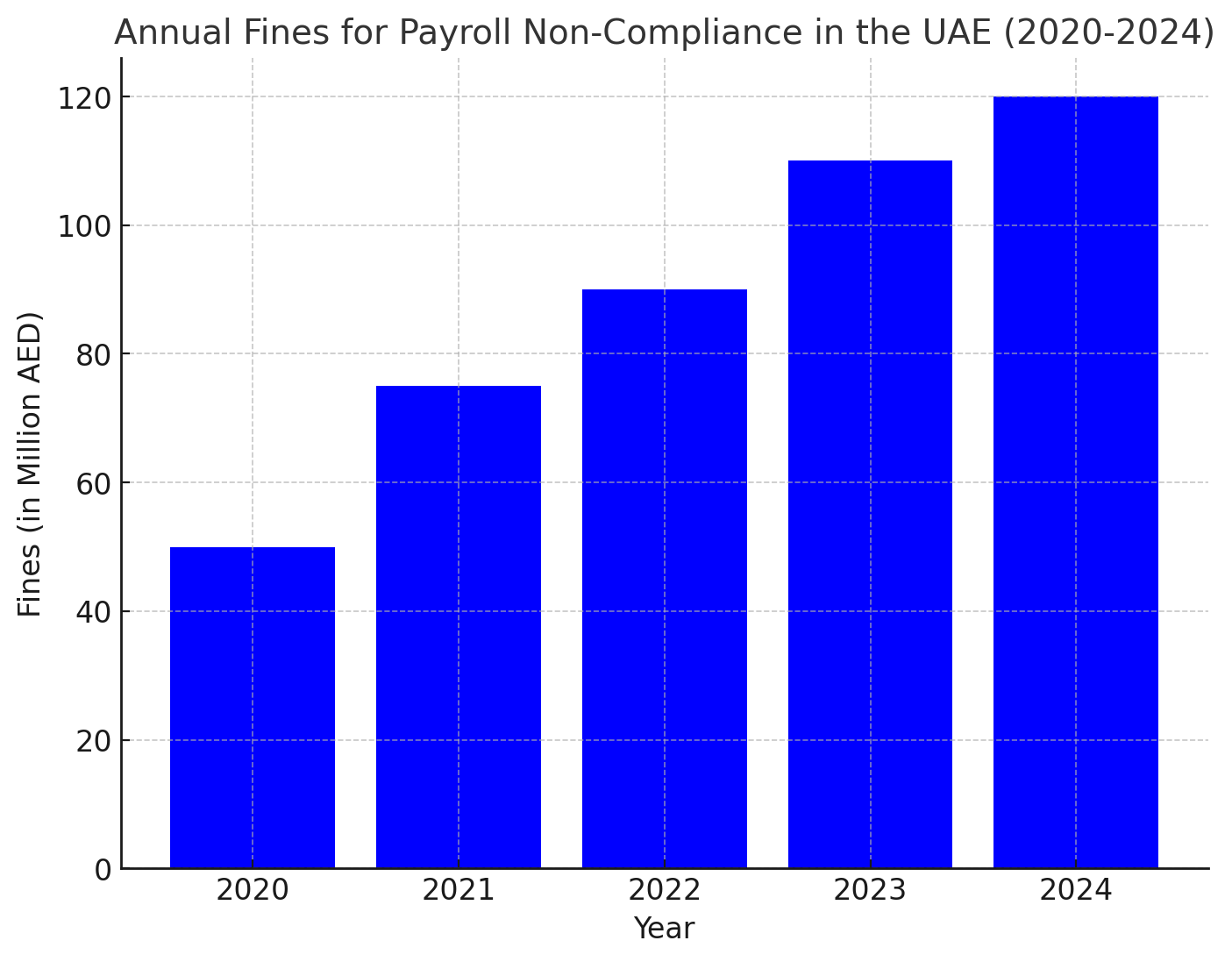

The financial implications are substantial. In 2023, non-compliance fines collected by MOHRE exceeded AED 100 million where as in 2024 it increased from 100 million AED to 120 million AED. Small businesses accounted for 60% of these penalties, underscoring the importance of robust payroll management systems.

Emerging Trends in Payroll Compliance in the UAE

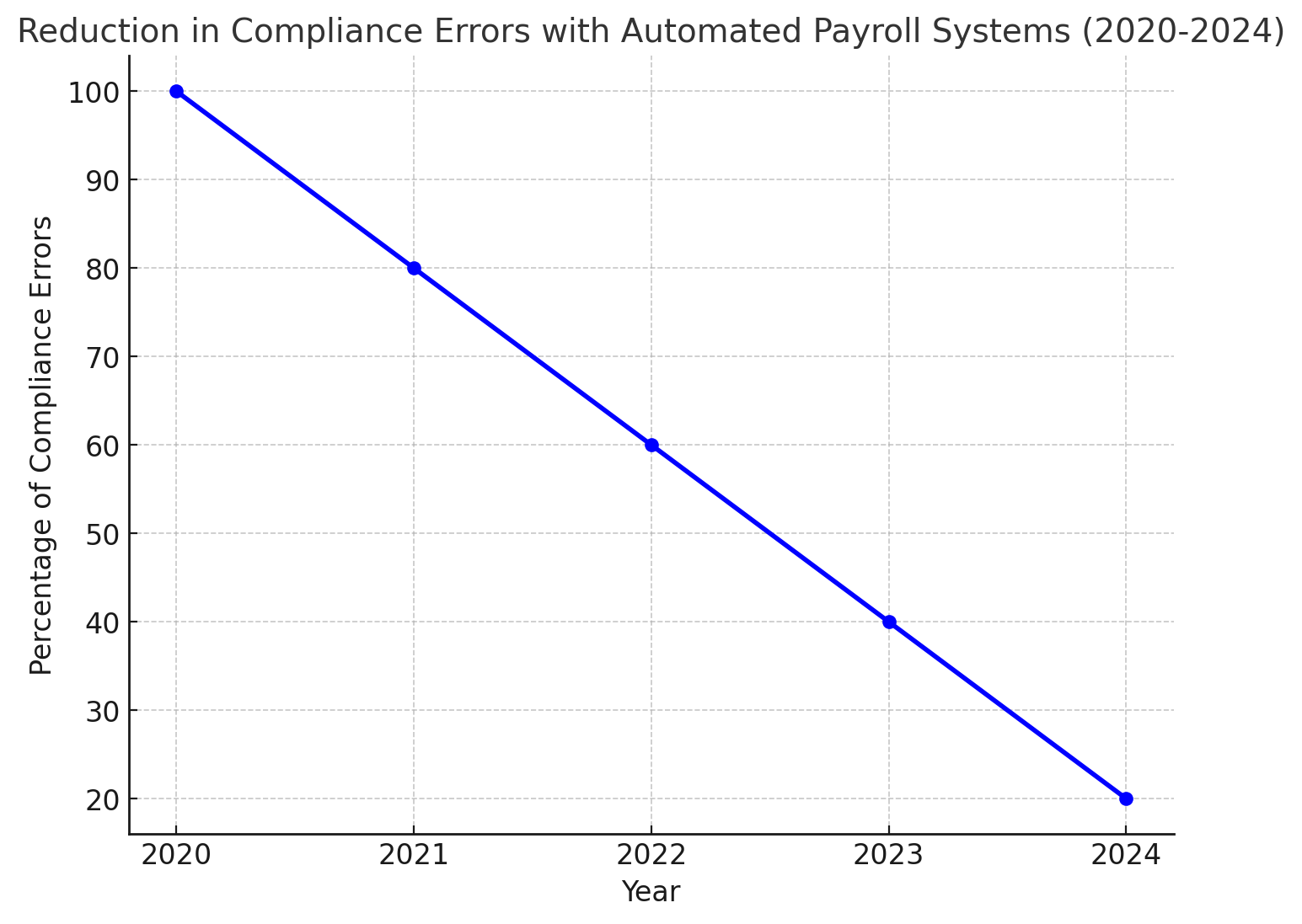

Technology is transforming payroll management in the UAE. Automated payroll solutions ensure compliance with WPS and other local requirements. For example, companies using AI-driven payroll platforms reported a 75% reduction in compliance errors in 2023, as per a Deloitte survey.

Integration with accounting systems is another key trend. These integrations ensure accurate financial reporting and reduce manual errors. Businesses leveraging integrated payroll solutions experienced a 50% improvement in operational efficiency in 2024, according to a QuickBooks study.

Why Payroll for a Single Employee in the UAE Requires Strategic Management

Managing payroll services for one employee in the UAE involves the same level of regulatory scrutiny as larger organizations. Small businesses and startups often lack the necessary payroll expertise, increasing the likelihood of errors. Even minor mistakes, such as delayed WPS submissions or incorrect gratuity calculations, can result in audits and fines.

Key Challenges in Managing Payroll for UAE Expatriates

UAE businesses often employ expatriates, adding another layer of complexity. Payroll management must account for visa costs, benefits, and any contractual obligations tied to relocation. Expatriate salary structures typically include allowances such as housing and transportation, making compliance management even more intricate.

Unveiling Payroll Risks: Why Compliance in the UAE is a Non-Negotiable Priority

Payroll compliance in the UAE is not merely a legal obligation—it’s a cornerstone of operational stability. The country’s regulatory framework mandates businesses to comply with the Wages Protection System (WPS), End-of-Service Benefits (EOSB), and labor laws that address expatriate workers and equal pay for all genders. Failure to comply can result in:

- Severe Penalties: Non-compliance with WPS alone resulted in AED 50 million in fines in 2023, and this figure is expected to grow by 20% annually.

- Business Disruptions: Companies facing compliance violations risk license suspensions and reputational harm, which could lead to contract terminations with key clients.

For businesses, especially SMEs, staying ahead in compliance means investing in robust payroll systems and staying updated with evolving regulations.

How the VAT Framework Impacts Payroll Management

While payroll itself is not subject to VAT, its integration with other financial operations can have implications for compliance. For example, service fees from outsourced payroll providers are often subject to VAT, necessitating proper accounting and documentation.

The Role of Technology in Simplifying UAE Payroll Compliance

- Automation and Cloud-Based Payroll Solutions

Automation reduces errors by handling WPS submissions, gratuity calculations, and compliance tracking. Cloud-based platforms ensure real-time updates to UAE labor laws and secure data storage, meeting legal requirements. A 2024 survey by ADP revealed that 68% of businesses using automated payroll systems in the UAE reduced compliance-related costs by an average of 30%.

- Data Analytics for Predictive Compliance

Advanced analytics tools help businesses identify potential risks before they escalate. Predictive models allow timely interventions, reducing the likelihood of compliance failures. For example, analytics-driven insights helped UAE companies save AED 5 million in fines in 2023 by preemptively addressing payroll discrepancies.

Remote Workforce Revolution: The Hidden Compliance Challenges in UAE Payroll

The adoption of remote work is redefining the payroll landscape in the UAE. With employees working across emirates and even internationally, businesses are now grappling with:

Taxation Complexities:

- Each emirate has unique tax considerations, and international workers may trigger double taxation treaties

Data Privacy Concerns:

- Ensuring payroll systems comply with global privacy standards such as GDPR has become a top priority, particularly for UAE companies with remote teams in Europe.

In a 2024 survey by Gulf HR Solutions, 65% of companies with remote teams identified payroll compliance as their top operational challenge. These businesses also reported a 30% rise in payroll administrative costs due to these complexities.

Sector Spotlights: Payroll Compliance Challenges in High-Risk Industries

Different sectors in the UAE face unique payroll compliance hurdles. Let’s explore the most vulnerable industries:

- Construction: Known for employing a large expatriate workforce, the construction sector accounted for 35% of all WPS violations in 2023. This is attributed to:

- Delays in payment due to project-based work.

- Frequent employee turnover complicates gratuity calculations.

- Healthcare: With the introduction of mandatory health insurance for employees in 2024, healthcare providers are struggling to:

- Properly integrate health insurance premiums into payroll systems.

- Address disputes over incomplete insurance coverage.

- Retail and Hospitality: Known for part-time and seasonal workers, these industries often face challenges in adhering to overtime regulations and managing holiday pay. A 2024 report indicated that 20% of payroll disputes originated from these sectors.

Strategies to Enhance Payroll Compliance in the UAE

Outsourcing payroll services for one employee to UAE-based specialists ensures compliance with local regulations and reduces administrative burdens. A PwC analysis in 2023 found that businesses outsourcing payroll operations achieved 20% higher accuracy rates in compliance-related tasks.

How Insights Can Help You Streamline Payroll Compliance

Managing payroll services for one employee effectively requires tools that ensure accurate calculations and compliance. Insights UAE provides comprehensive solutions that allow businesses to focus on growth while we handle the intricacies of payroll compliance. Contact us today to transform your payroll operations.

Comprehensive Payroll Solutions: Our tools ensure accurate calculations for salaries, gratuity, and EOSB, minimizing risks.

UAE Regulatory Compliance Expertise: We stay updated with UAE labor laws and WPS requirements to keep your payroll compliant.

Automation and Integration: Our automated systems seamlessly integrate with accounting tools for efficiency and accuracy.

Real-Time Support: Our experts provide immediate assistance with payroll-related queries, offering peace of mind.

Partnering with Company Insights allows UAE businesses to focus on growth while we manage the complexities of payroll compliance. Contact us today to transform your payroll operations.

Outsourcing Payroll: A Strategic Move for UAE Businesses

Managing payroll internally might seem cost-effective, but the complexities of compliance in the UAE often make outsourcing a smarter choice. Key benefits of outsourcing include:

- Access to Expertise: Outsourced providers stay updated on the latest labor laws, ensuring full compliance.

- Time Savings: Businesses can focus on core activities while professionals handle payroll intricacies.

- Cost Efficiency: By avoiding penalties and streamlining processes, companies save an average of AED 20,000 annually, as reported by PwC in 2024.

With over 50% of UAE businesses already outsourcing their payroll functions, this trend is expected to grow in the coming years.